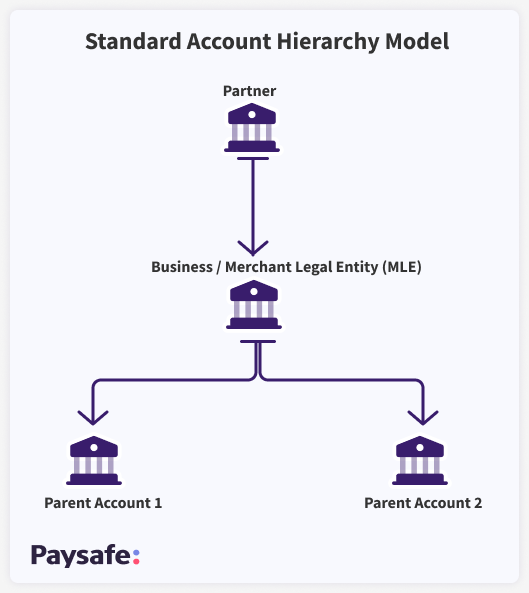

Standard Account Hierarchy Model

The standard account hierarchy model allows the partner to create merchant accounts based on the payment methods requested. The partner account may collect fees in case use-case requires it.

Paysafe supports a hierarchy structure to mirror the relationships between various business units.

A platform partner integrates with Standard Account Hierarchy model for the following benefits:

- The most popular way to do onboarding, used by several industries

- The bank account verification is automated during onboarding. (Manual in CA currently)

- The KYC checks are automated during onboarding.

- Accounts are enabled quickly: thanks to Paysafe's auto-adjudication process and auto-onboarding engine.

The following table describes the different elements in the hierarchy model.

| Name | Description | Relationship |

|---|---|---|

| Partner | This represents the entity integrated with Paysafe. Paysafe creates the Merchant Setup Config for each partner. The API calls happen between the Partner and Paysafe and is identified with the Merchant Setup Config id. | A partner can have more than one Configs associated. |

| Business/Merchant Legal Entity (BLE) | This represents one of your merchants you have on-boarded. This should represent the Legal Entity under which the business is held. | A Partner can have one or more BLE's linked to it. |

| Doing Business As (DBA) | This represents the various Locations or Websites that are run by the BLE. This represents the various trading entities that come under the BLE. | A BLE can have one or more DBA's linked to it. |

| Account | This is the account on the Paysafe platform through which transactions are processed. It includes the bank at which transactions will be settled. | Different payment method/currency combinations can be specified for each Account. |

| Merchant Setup Config | Merchant Setup Config defines the configurations required for processing and provisioning the merchant's application. Merchant Setup config comprises the following:

Note: Paysafe will configure the merchant config setup as per the agreement between the partner and Paysafe. If your merchant config setup is not created, contact your Account Manager. | A partner can have more than one Merchant setup configs associated based on the pricing offered for the merchants. |

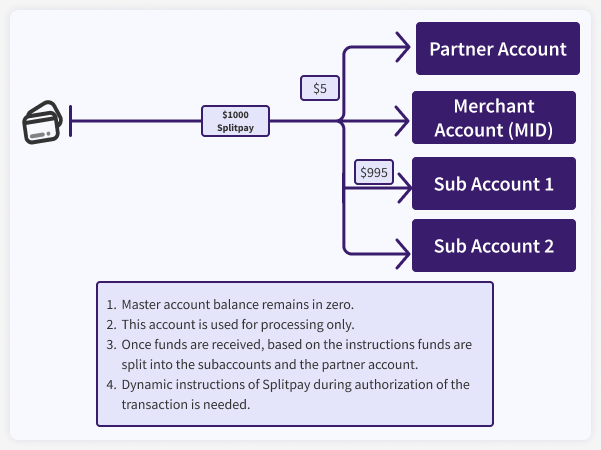

Split Payments

Splitpay is supported as part of Standard Hierarchy model. The platform partner needs to be setup with Split Payment capability, and all merchants under the platform will inherit split payments. For more information, see Split Payouts overview.

How Splitpay works?

- Process a transaction on the merchant account, and from the Splitpay feature a portion of the transaction could be passed to the platform (for collection).

- Partner Account is the platform account for fee collection (if required).

- Merchant accounts (Processing Accounts).

- For example: $100 is splitted as per the instructions during the Auth call - Splitpay.

- According to the payment schedule defined in the merchant account, it sends the money to the destination bank account setup.

Note: The above information is for introductory purpose, please contact your Account Manager to understand which model fits your needs. You can find more details on Split Payments.