Subaccounts

Subaccounts allow merchants to share and distribute payments among multiple accounts. When you create a subaccount, it will be connected with the merchant account ID that is specified in the request endpoint.

- Create the subaccounts you require. The subaccounts are settlement accounts only, connected with the Merchant Accounts whose account IDs are included in the endpoint for the subaccount creation requests. No transaction requests are processed through the subaccounts.

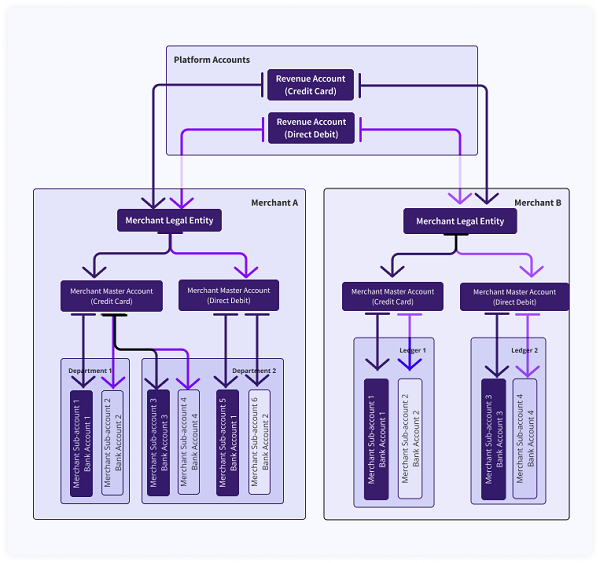

In the image below, you can see the following were created:- Two subaccounts of Department 1 for Credit Card in multiple banks for Merchant A.

- Two subaccounts of Department 2 for Credit Card in multiple banks for Merchant A.

- Two subaccounts of Department 2 for Direct Debit in multiple banks for Merchant A.

- Two subaccounts of Ledger 1 for Credit Card in multiple banks for Merchant B.

- Two subaccounts of Ledger 2 for Direct Debit in multiple banks for Merchant B.

Subaccount Settlement Flows

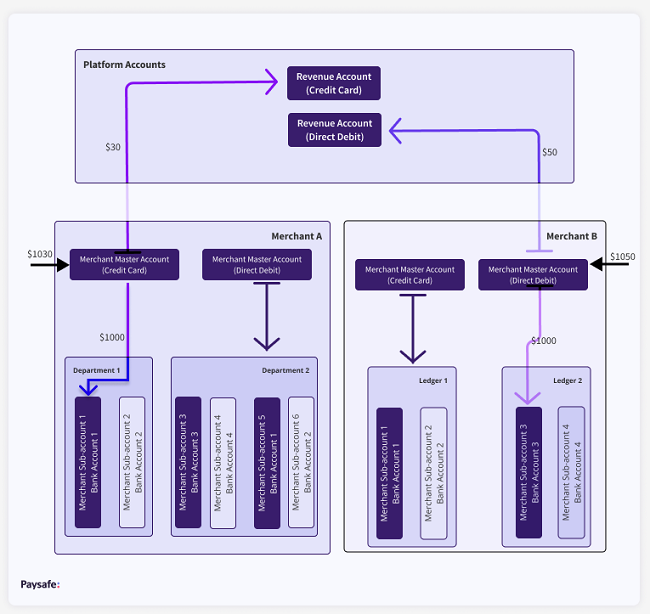

The diagram below shows a sample flow of settlement funds when you have Subaccounts associated with your Merchant Accounts.

- Merchant A receives a credit card payment of $1030 to their Merchant Account.

- Merchant A processes a Split Payout purchase request, specifying the Revenue Account and Subaccount 1 each as a linked Account and the amount to go to each.

- $1000 of the total amount goes to their Subaccount 1 in Department 1, which is a settlement account only and has a bank account assigned to it.

- $30 of the total amount goes to their credit card platform Revenue Account.

- Merchant B receives a Direct Debit payment of $1050 to their Merchant Account.

- Merchant B processes a Split Payout Direct Debit purchase request, specifying the Revenue Account and Subaccount 3 each as a linkedAccount and the amount to go to each.

- $1000 of the total amount goes to their Subaccount 3 in Ledger 2, which is also a settlement account only and has a bank account assigned to it.

- $50 of the total amount goes to their Direct Debit platform Revenue Account.

For the Card Refund or Direct Debit Standalone Credit, the merchant or platform initiating the transaction needs to specify the splits and the corresponding linked accounts they want these splits retrieved from, if required. In other words, processing a Refund/Standalone Credit without adding any splits in the request will not automatically retrieve any funds from the linked accounts even if the original transaction was a Split Payout.

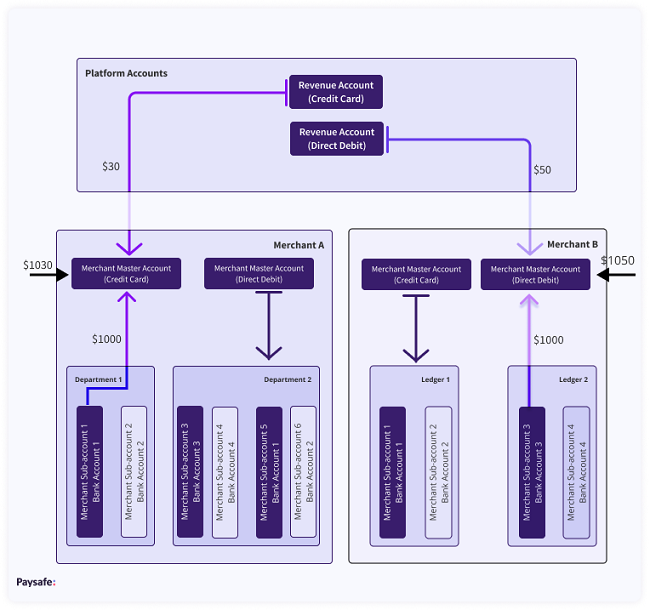

The diagram below shows a sample flow of credit funds when you have Subaccounts associated with your Merchant Accounts.

- Merchant A issues a credit card refund of $1030 from their Merchant Account.

- Merchant A processes a Split Payout refund request, specifying the Revenue Account and Subaccount 1 each as a linkedAccount and the amount to come from each.

- $1000 of the total amount goes from their Subaccount 1 in Department 1 to the Merchant Account.

- $30 of the total amount goes from their credit card platform Revenue Account to the Merchant Account.

- Merchant B issues a Direct Debit credit of $1050 from their Merchant Account.

- Merchant B processes a Split Payout Direct Debit standalone credit request, specifying the Revenue Account and Subaccount 3 each as a linkedAccount and the amount to come from each.

- $1000 of the total amount goes from their Subaccount 3 in Ledger 2 to the Merchant Account.

- $50 of the total amount goes from their Direct Debit platform Revenue Account to the Merchant Account.

When Card chargebacks or Direct Debit Returns get posted for a Split Payout transaction, the merchant or platform initiating the transaction needs to transfer the corresponding balances between linked accounts to offset, if required, any portions originally transferred between them through Split Payouts.

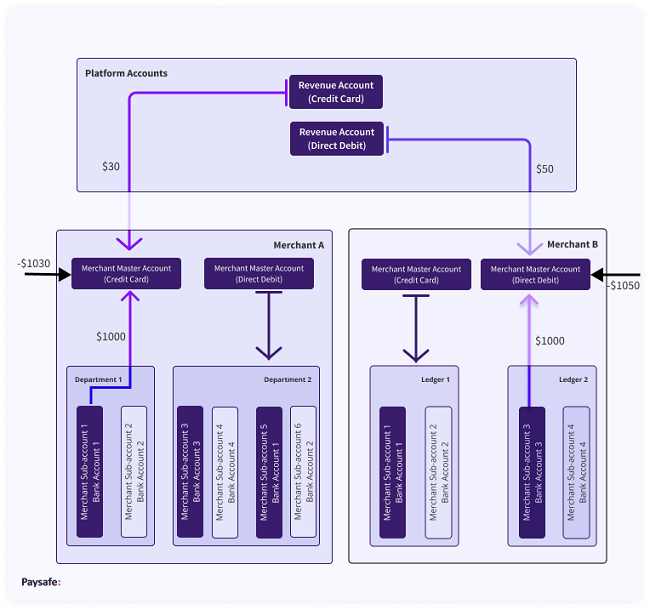

The diagram below shows a sample flow of funds for credit card chargebacks and Direct Debit returns when you have Subaccounts associated with your Merchant Accounts.

- A chargeback of $1030 is levied against the credit card Merchant Account of Merchant A.

- Merchant A processes a credit transfer request to transfer $1000 from their Subaccount 1 in Department 1 (the linkedAccount in the request body) to the Merchant Account.

- Merchant A processes another credit transfer request to transfer $30 from their credit card Revenue Account (the linkedAccount in the request body) to the Merchant Account.

- A return of $1050 is levied against the Direct Debit Merchant Account of Merchant B.

- Merchant B processes a credit transfer request to transfer $1000 from their Subaccount 3 in Ledger 2 (the linkedAccount in the request body) to the Merchant Account.

- Merchant B processes another credit transfer request to transfer $50 from their Direct Debit Revenue Account (the linkedAccount in the request body) to the Merchant Account.