Authorization Followed by Settlement

An authorization verifies that the customer's credit card account is valid and that sufficient funds are available to cover the transaction.

- With the authorization request, the funds are held and deducted from the customer's credit card limit (or bank balance, in the case of a debit card) but are not transferred to the merchant's account until the merchant settles (or captures) the transaction.

- For debit cards, authorization holds can expire (thus rendering the balance available again) anywhere from 1–5 days after the transaction date, depending on the bank's policy.

- For credit cards, authorization holds may last as long as 30 days, depending on the issuing bank.

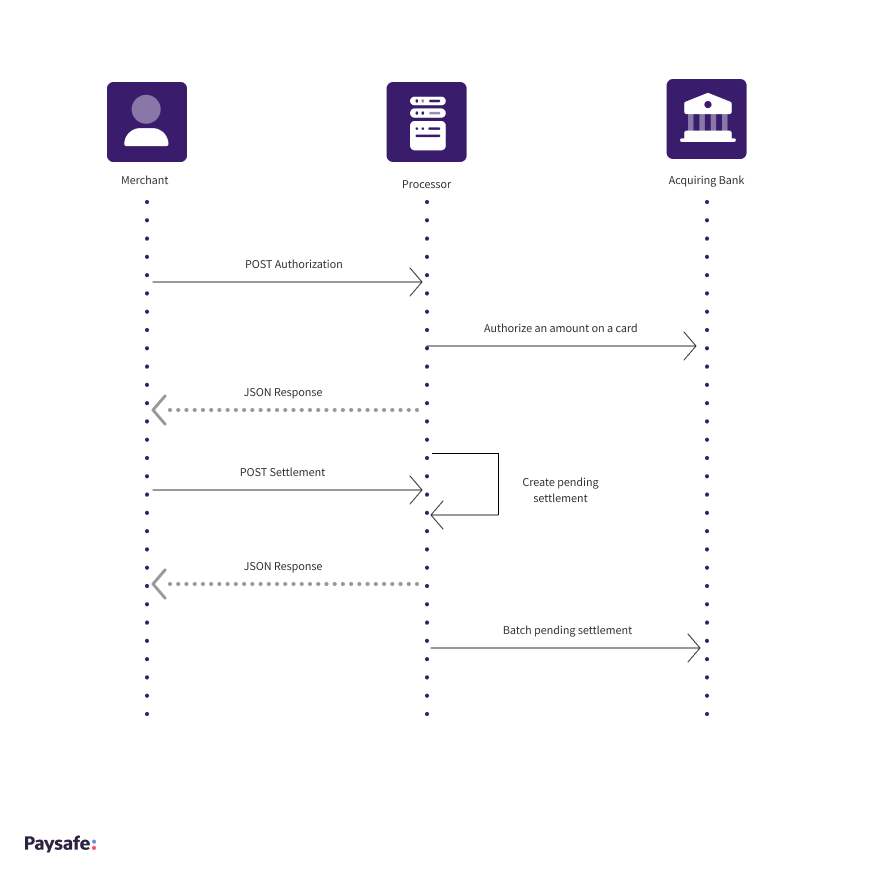

Authorization and Settlement Message Sequence

- The Merchant posts an authorization request for a specific amount to the Paysafe Group platform and if successful, receives a response indicating that the request was authorized.

- When the merchant is ready, they send a request to Paysafe Group to settle the transaction (capture the authorized funds). The pending settlement request is sent in a batch file to the card issuer, typically at the end of the day.

Was this page helpful?

On this Page