Scenarios

Use of the Card Payments API requires you to collect cardholder details, such as the card number, expiry date, and CVV/CVC code on your e-commerce website and send these to Paysafe with your API request.

See the scenarios below describing a number of alternative ways in which merchants can set up card payment processing with Paysafe.

This is typically used by merchants who provide immediate delivery of the order without delayed payment capture.

API to use: Card API Auth

In the above scenario, the merchant uses the Card Payments API to request an authorization with a settlement. The parameter settleWithAuth is set to true. Once the authorization is made, the funds are immediately requested from the card issuer with the next Paysafe batch settlement run.

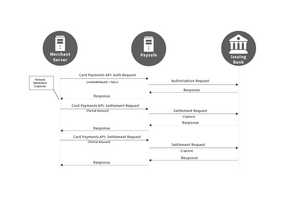

This is typically used by merchants who obtain authorization for an initial purchase amount and capture payments at a later stage, for example, after fulfillment of the order.

API to use: Card API Auth + Card Payments API Settlement

In the above scenario, the merchant uses the Card Payments API to request an initial authorization, with the parameter settleWithAuth set to false. This enables the merchant to delay issuing the settlement (payment capture) request until the order is fulfilled. The merchant may make one or more partial settlement requests, up to the full amount on the original authorization.

Depending on the card issuer, an authorization is typically valid for between 1–5 days (debit cards) or up to 30 days (credit cards) before it expires and a new authorization must be obtained.

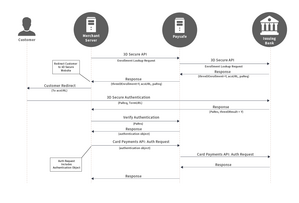

This is typically used by merchants trading in regions where the cardholder is authenticated by the card issuer prior to payment authorization.

API to use:3D Secure API + Card Payments API

In the above scenario, the merchant uses the 3D Secure API to authenticate cardholders enrolled in 3D Secure and then uses the Card Payments API to request an initial authorization; the authorization request contains the PaRes parameters returned by the card issuer following a successful cardholder authentication.

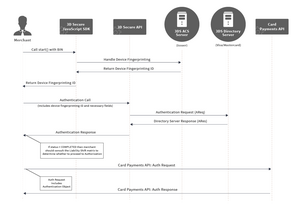

This is typically used by merchants trading in regions where the cardholder is authenticated by the card issuer prior to payment authorization.

API to use: 3D Secure 2 API + Card Payments API

In the above scenario, the merchant uses the 3D Secure 2 JavaScript SDK and API to collect the device fingerprint ID and authenticate the cardholder. The merchant then uses the Card Payments API to request an initial authorization; the authorization request contains authentication parameters returned by the card issuer following a successful cardholder authentication.

This diagram displays a "frictionless" scenario; to learn about other 3D Secure 2 scenarios, see the 3D Secure 2 section.

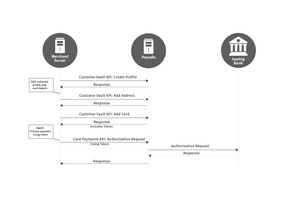

This is typically used by merchants who offer repeat billing and subscription-based services, as well as by merchants who want to offer customers payments via mobile and smart phone devices.

API to use: Customer Vault API + Card Payments API

In the above scenario the merchant uses the Customer Vault API to set up a new customer profile and add customer address and card details to the profile.

When a card is added to a customer's profile, Paysafe returns a unique token which can be used for future payments linked to that card.

Whenever the merchant wants to process a payment for the cardholder, they make an authorization request using the Card Payments API: the request includes the token for the card being used to make the payment, plus the amount to be authorized.

The first time the token is used, we recommend that you obtain the customer's CVV for the initial authorization and append it to the authorization request. For details, see Customer Vault API.