Going Live

This topic describes how to apply for a live account, set up currency accounts, and move from the Test to the Production environment.

Applying for a Live Account

Apply for a live Paysafe merchant account and start taking payments by clicking the appropriate link below:

For more information on how to obtain a merchant account, please contact Merchant Sales for your region.

Multiple Accounts

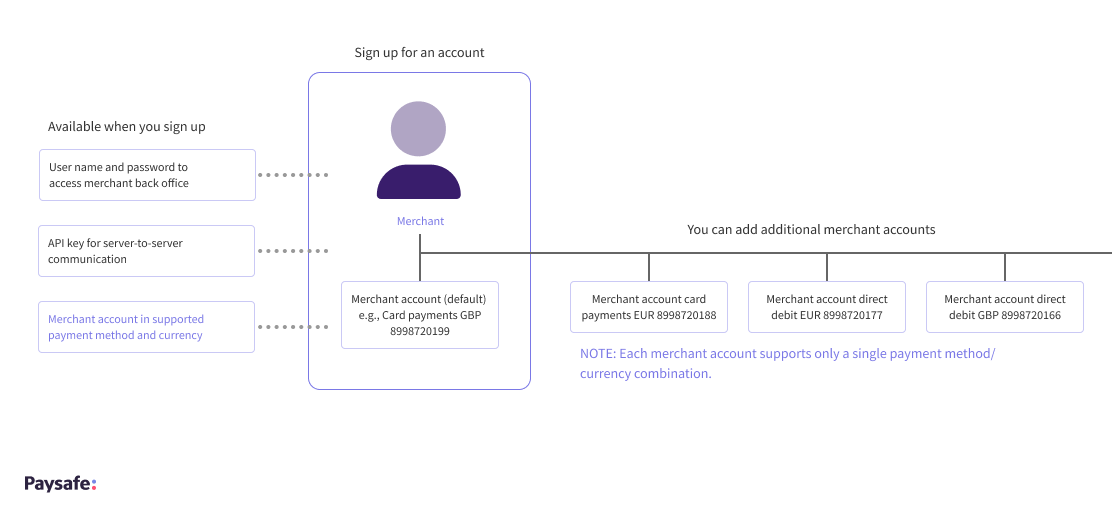

You can use the default account to process Visa and Mastercard card payments (using the Card Payments, Customer Vault, Hosted Payments, and 3D Secure APIs). You need to open separate accounts for other card brands.

If you want to support payments in a different currency, you will need additional accounts for each payment method/currency combination. See the figure below.

- If you need accounts to support additional card brands such as Amex, Diners, and JCB, please Contact Support.

- All your accounts can be set up to use the same API key (and in some cases, this will happen automatically). Please contact Customer Support for more information.

Using Currencies with Production Accounts

A production account has an associated currency in which funds are settled (paid into the account). For example, if you have a GBP account, funds will be paid into your account in GBP. The default account currency is used to take and process payments from your customers. For a list of currencies and the corresponding codes, see Currency Codes.

Please note that you will incur currency conversion costs when the currency in which customer payment is made is different from the currency of the merchant account into which the funds are settled. You must therefore open a separate merchant account for each currency you want to accept funds in.

Managing Payments via the Merchant Back Office

You can sign in to the Paysafe Merchant Back Office to view the status of your transactions, configure customized reports, and perform additional payment actions such as bulk uploads and payments via the Virtual Terminal.

We recommend that you set up customized reports to receive details of transactions, settlements, and chargebacks.

Moving from Test to Production Environment

The Test and Production environments are two separate integrations. Your API requests in the Production environment must use your Production account details:

- Production merchant account number

- Production API Key

To process live transactions, your API requests should point to the Production API endpoints:

https://api.paysafe.com

For example:

https://api.paysafe.com/cardpayments/v1/accounts/account_id

You will need to repeat any configuration changes made to your Test account on the Production account. Keep a record of any changes requested and carried out.

Go Live Checklist

See below for details of website compliance and other checks that should be completed before going live.

Before switching an account to live, Paysafe will carry out compliance checks on all merchants who are using Paysafe as their acquirer. For merchants using a different acquirer, additional compliance checks may apply. Contact your acquirer for details.

Payment Processing

- Make sure you have submitted the necessary documentation or evidence to support any PCI DSS compliance requirements.

- Ensure you have tested your supported payment methods in a number of scenarios, including success, failed, and pending, and in an end-to-end process (i.e., from website order through to final settlement and payment, including handling of cancelled transactions and refunds).

- Ensure your customer support, operations, logistics, and finance teams have been trained to support the new system.

- Please supply any additional information requested by your Paysafe Sales representative or account manager.

Website Compliance

Before you go live with the Paysafe service, please make sure that your e-commerce website provides the following information:

- Payment Method Logos of the payment methods you are offering through Paysafe. For a list of icons you can use, see Payment Method Logos.

- Company Name and Registration Number (if applicable)

- Full Terms and Conditions of Your Service

- Privacy Policy – complying with local Data Protection legislation and explaining how you deal with customers’ personal information. Your policy should state that you do not share or sell customers’ personal information to third parties.

- Returns Policy – describing what happens when a customer wants to return an item ordered on your website. Your policy should include a “cooling off” period for your online customers to decide if they want to cancel the order on your website and/or return the goods or services.

- Your Contact Details

- Where customers can reach you and return unwanted or faulty items. You should include the business address from which you operate or trade, an email address, and a phone number. Note that providing a PO box as a contact address is not acceptable.

- When you submit your application, please send us: i) Website addresses – URLs to the pages on your website that display the above information; and ii) any login details needed to access these URLs.

Further information may be required for higher-risk businesses. You will also be asked to confirm that your website is owned by your business or organization.

Businesses trading in the European Union must provide this information to comply with the Distance Selling Regulations. Similar regulations apply to other regions.