Scenarios

You can use the Direct Debit API to accept payments directly from customer bank accounts. Several major bank schemes are supported, and you can take advantage of tokenized Direct Debit requests when you store your customers' bank data in the Customer Vault — perfect for subscriptions, memberships, and other forms of repeat payments.

See the scenarios below describing a number of alternative ways in which merchants can set up Direct Debit payment processing with Paysafe.

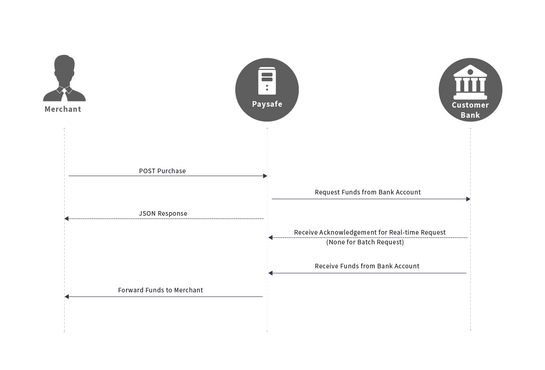

This scenario illustrates a merchant who takes payment for an order from a customer's bank account, via Direct Debit.

API to use: Direct Debit API Purchase

In the above scenario, the merchant uses the Direct Debit API to post a purchase request to Paysafe. For a real-time purchase request, the funds are immediately requested from the customer's bank account. For a batch request, the funds are requested with the next Paysafe batch run.

Depending on the bank, it may take 3–5 days for the funds to clear. Merchants should not ship any goods until the status of the Direct Debit payment is confirmed.

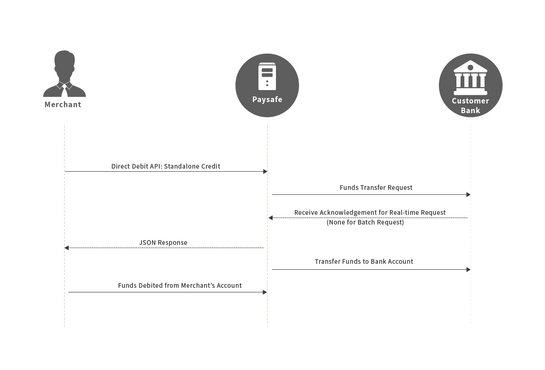

This scenario illustrates a merchant who makes a payment (standalone credit) to a customer's bank account, for example for payment of winnings (online gaming) or to process a refund.

API to use: Direct Debit API Standalone Credit

In the above scenario, the merchant uses the Direct Debit API to post a standalone credit request to Paysafe. For a real-time credit request, the funds are immediately requested from the merchant's bank account. For a batch request, the funds are requested with the next Paysafe batch run.

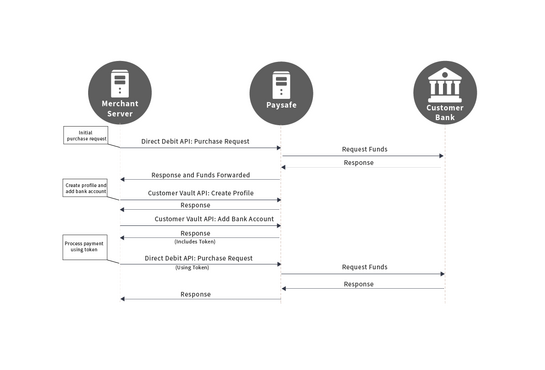

This request type is typically used by merchants who offer repeat billing and subscription-based services and want to take repeat payments from the customer's bank account.

API to use: Customer Vault API + Direct Debit API Purchase

In the above scenario the merchant uses the Customer Vault API to set up a new customer profile and add customer address and bank account details to the profile.

When a bank account is added to a customer's profile, Paysafe returns a unique token that can be used for future payments linked to that account.

Whenever the merchant wants to process a payment for the customer, they make a purchase request using the Direct Debit API. The request includes the token for the bank account being used to make the payment, plus the purchase amount.