Boleto Bancario

Boleto Bancario is a voucher-based payment method used in Brazil. Customers can pay for vouchers in various ways, including cash, online and at ATMs.

The Paysafe Payments API supports Boleto Bancario via SafetyPay as a Payment Instrument for iGaming and Crypto merchants in Brazil.

Features

Boleto Bancario:

- Allows you to accept payments from unbanked customers.

-

Has no chargebacks risks.

-

Expires if not paid by the Boleto expiration date - if Boleto is not paid in the appropriate time it expires and the transaction is cancelled.

-

Is one of the most popular payment methods in Brazil.

Setup Requirements

To create accounts in both the sandbox and production environments:

- Send your details to it_integrations@safetypay.com

You will receive access to a Portal where you will be able to access the following keys:- Merchant Secret Key

- Merchant Signature Key

- Share these details with us to create your API Key - you will use this API key in your API calls.

Your account manager will help to guide you through this process.

Certification Requirements

You are required to go through a certification process to support Safetypay Express as a payment method.

The Paysafe integration team will share the certification requirements with you.

Transaction Types

Paysafe supports the following transaction type:

- Payments - used to transfer money from a customer's bank account to your merchant account. After successful payment, you credit the customer's wallet.

Minimum amount: No minimum amount

Maximum amount: BRL 57,000

Processing currency: BRL

Settlement currency: USD

Typical Scenarios

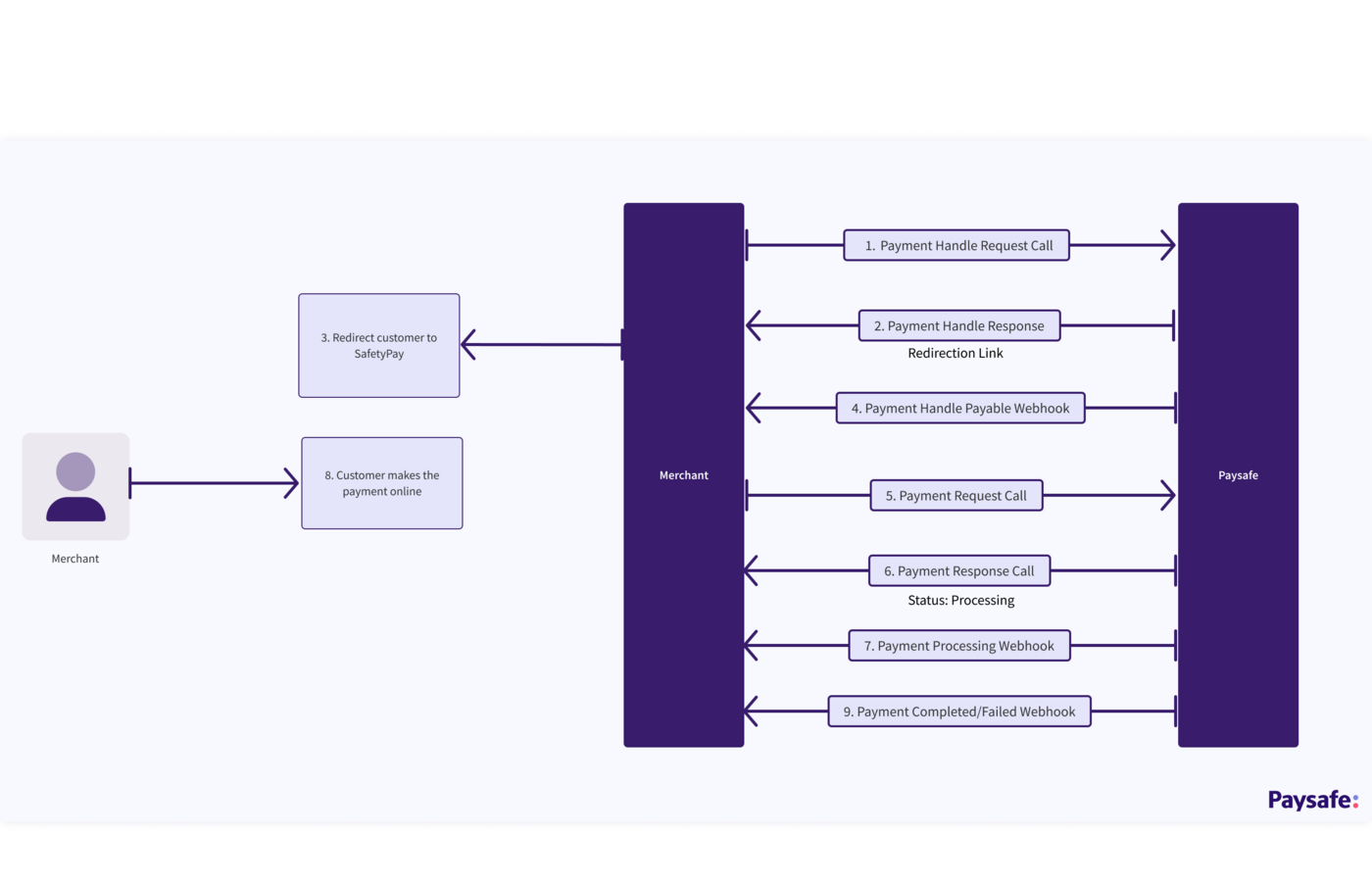

To process a payment request using Boleto Bancario as the payment type:

-

Create a Payment Handle with the following parameter settings:

transactionType: PAYMENT

paymentType: BOLETO_BANCARIO -

Redirect the customer to the SafetyPay redirect URL so that they can generate a payment code.

The status of the Payment Handle will change to PAYABLE - you will be notified of this status change via your configured webhooks. -

Use the paymentHandleToken returned in the response to process the Payment request.

The payment will have a status of PROCESSING until the customer has made the payment.

You will receive a Payment Completed notification via webhooks when the customer successfully completes the payment.

If you don't receive webhooks, you can use a GET call to query the transaction status. However, we recommend that you avoid constant polling of the API.

See Webhooks and GET calls for more information.

Return links

- After the customer has been redirected to SafetyPay Express, you will receive a Payment Handle Payable webhook. When you make a /payments call, you will get a payment status of either Processing, Completed or Failed.

- After the customer completes the transaction at Safetypay Express, the customer will be redirected to your return link. You can check the status of the /payments response and redirect the customer to your relevant page depending on the payment status:

| Payment status | Description |

|---|---|

| PROCESSING | The transaction is not complete and is in progress. It does not mean that the transaction has failed. You will get a COMPLETED or FAILED webhook for this transaction at a later stage when you will be able to update the transaction status at your end. |

| COMPLETED | The customer has successfully completed the transaction at the SafetyPay end. |

| FAILED | The payment has expired at the SafetyPay end. |

APIs to use

Code Examples

{

"amount": 500,

"currencyCode": "BRL",

"merchantRefNum": "eb3b3cbe-1386-4c38-b967-63a90249e946",

"transactionType": "PAYMENT",

"paymentExpiryMinutes":15,

"accountId": "1002622940",

"paymentType": "BOLETO_BANCARIO",

"profile": {

"email": "brlspcash@gmail.com"

},

"returnLinks": [

{

"rel": "default",

"href": "http://www.amazon.ca"

}

]

}

{

"id": "be8b6064-2bf2-4e4b-88e8-ed1b6a37e1fd",

"paymentType": "BOLETO_BANCARIO",

"paymentHandleToken": "PHxTXOEU9AAOErZc",

"merchantRefNum": "6708dd07-088d-4e63-a928-f2971ed07962",

"currencyCode": "BRL",

"txnTime": "2023-03-14T05:22:09Z",

"customerIp": "213.208.158.220",

"status": "INITIATED",

"links": [

{

"rel": "redirect_payment",

"href": "https://api.test.paysafe.com/alternatepayments/v1/redirect?accountId=1002622940&paymentHandleId=be8b6064-2bf2-4e4b-88e8-ed1b6a37e1fd&token=eyJhbGciOiJIUzI1NiJ9.eyJhY2QiOiIxMDAyNjIyOTQwIiwicHlkIjoiYmU4YjYwNjQtMmJmMi00ZTRiLTg4ZTgtZWQxYjZhMzdlMWZkIiwiZXhwIjoxNjc4NzczMTMwfQ.4dVPogQVZR62bhFCeNe5Gu-yRBiGxRKmkfUsgyrWU1k"

}

],

"liveMode": false,

"simulator": "EXTERNAL",

"usage": "SINGLE_USE",

"action": "REDIRECT",

"executionMode": "SYNCHRONOUS",

"amount": 500,

"timeToLiveSeconds": 898,

"gatewayResponse": {

"operationId": "0123073466306406",

"id": "8cf7e476-e5c8-4fa3-bb8e-c1048ae61f36",

"processor": "SAFETYPAY"

},

"returnLinks": [

{

"rel": "default",

"href": "http://www.amazon.ca"

}

],

"transactionType": "PAYMENT",

"gatewayReconciliationId": "8cf7e476-e5c8-4fa3-bb8e-c1048ae61f36",

"updatedTime": "2023-03-14T05:22:10Z",

"statusTime": "2023-03-14T05:22:10Z",

"paymentExpiryMinutes":15,

"profile": {

"email": "brlspcash@gmail.com"

}

}

Payment request

Boleto Bancario payment request using the paymentHandleToken received in the Payment Handle response:

{

"merchantRefNum": "4e3147e3-2bc0-4b9c-a43c-acf8d8b0e121",

"amount": 500,

"currencyCode": "BRL",

"dupCheck": true,

"settleWithAuth": true,

"paymentHandleToken": "PHxTXOEU9AAOErZc"

}

{

"id": "7d6d80d3-c56d-4dad-bd9c-0b5f88ddb169",

"paymentType": "BOLETO_BANCARIO",

"paymentHandleToken": "PHxTXOEU9AAOErZc",

"merchantRefNum": "3a0a62ed-78d3-44ac-8596-d009e51e7f92",

"currencyCode": "BRL",

"settleWithAuth": true,

"dupCheck": true,

"txnTime": "2023-03-14T05:22:09Z",

"customerIp": "213.208.158.220",

"status": "PROCESSING",

"gatewayReconciliationId": "8cf7e476-e5c8-4fa3-bb8e-c1048ae61f36",

"amount": 500,

"availableToRefund": 0,

"consumerIp": "213.208.158.220",

"liveMode": false,

"simulator": "EXTERNAL",

"updatedTime": "2023-03-14T05:23:18Z",

"statusTime": "2023-03-14T05:23:18Z",

"gatewayResponse": {

"operationId": "0123073466306406",

"id": "8cf7e476-e5c8-4fa3-bb8e-c1048ae61f36",

"processor": "SAFETYPAY",

"status": "101"

},

"availableToSettle": 0,

"profile": {

"email": "brlspcash@gmail.com"

},

"settlements": {

"amount": 500,

"txnTime": "2023-03-14T05:22:09.000+0000",

"availableToRefund": 0,

"merchantRefNum": "3a0a62ed-78d3-44ac-8596-d009e51e7f92",

"id": "7d6d80d3-c56d-4dad-bd9c-0b5f88ddb169",

"status": "PROCESSING"

}

}

Testing Instructions

| Country | currencyCode | countryCode | Instructions |

|---|---|---|---|

| Brazil | BRL | BR | On the SafetyPay Express page:

|