Settlement Flow Diagrams

Payment Integration Overview

Auto Settlement (One-Step Payment) Vs Manual Settlement (Two-Step Payment)

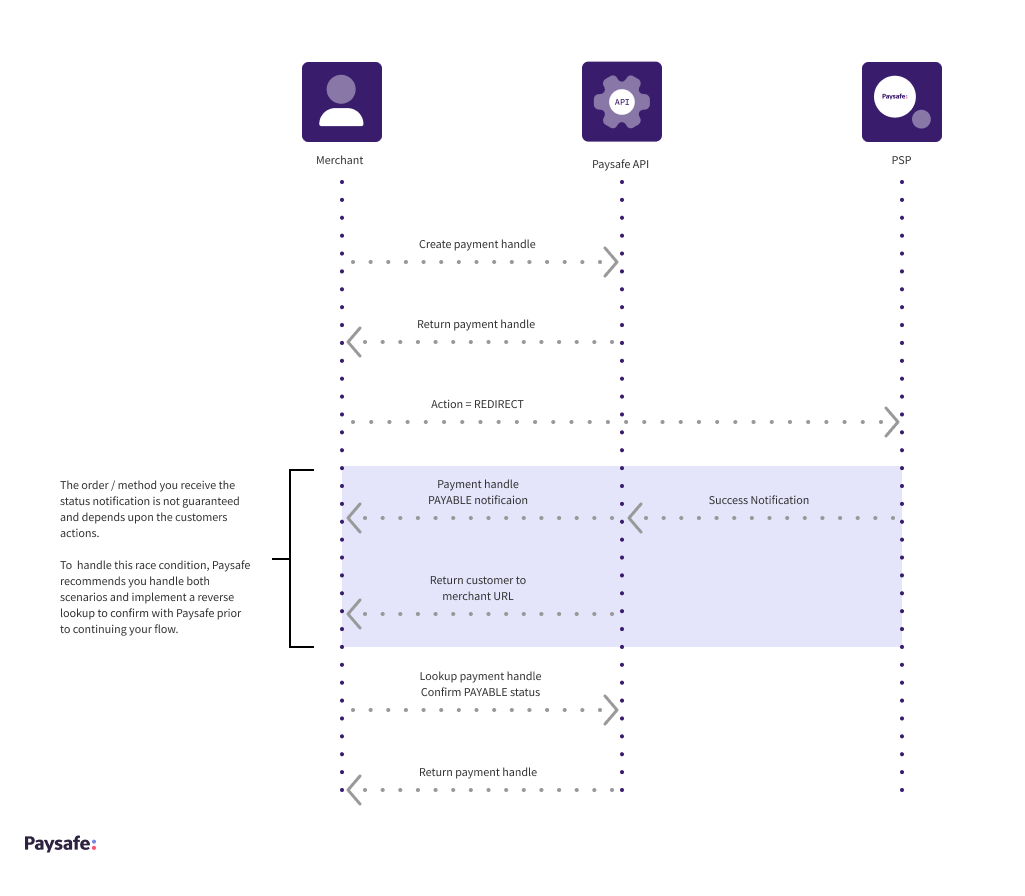

One-step payment gateway refers to payment integrations where authorization/capture of funds occurs at the same time. This is relatively common for many alternative payment methods where the customer authenticates and authorizes the payment through a channel provided by the PSP. Typically, once the customer has authorized the payment, funds are immediately allocated and confirmed by the PSP.

- Only supports settleWithAuth=true

- For these integrations, corresponding Payment and Settlement resources are created simultaneously to represent the transaction. Both resources utilize the same unique GUID as are created from the same request. For these integrations, the Payment should reflect the same status as the Settlement and can be used to indicate success or failure of the transaction request without having to do a separate lookup on the specific settlement.

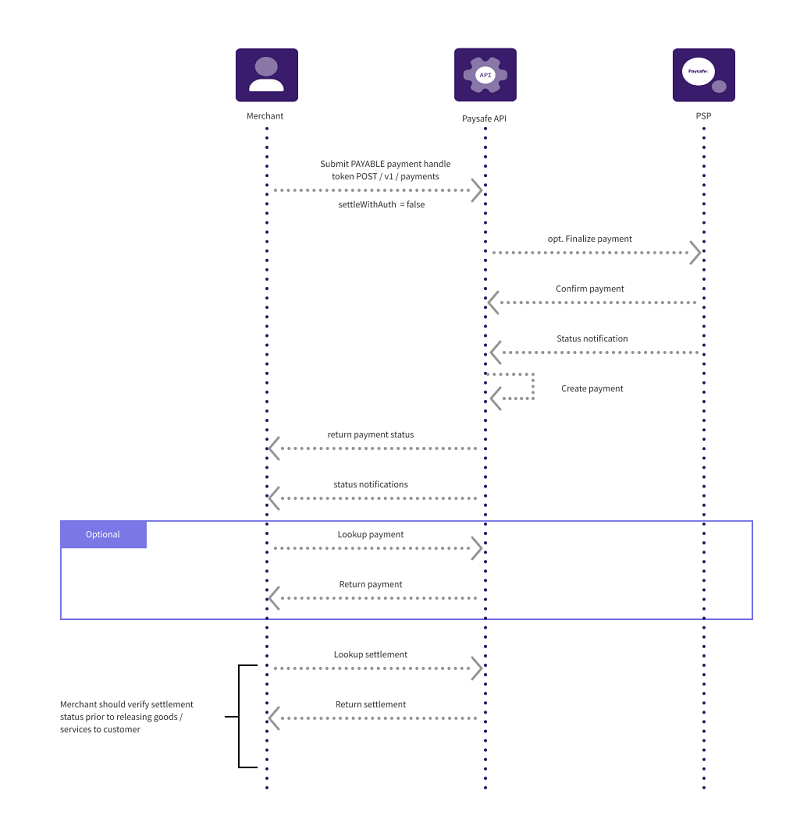

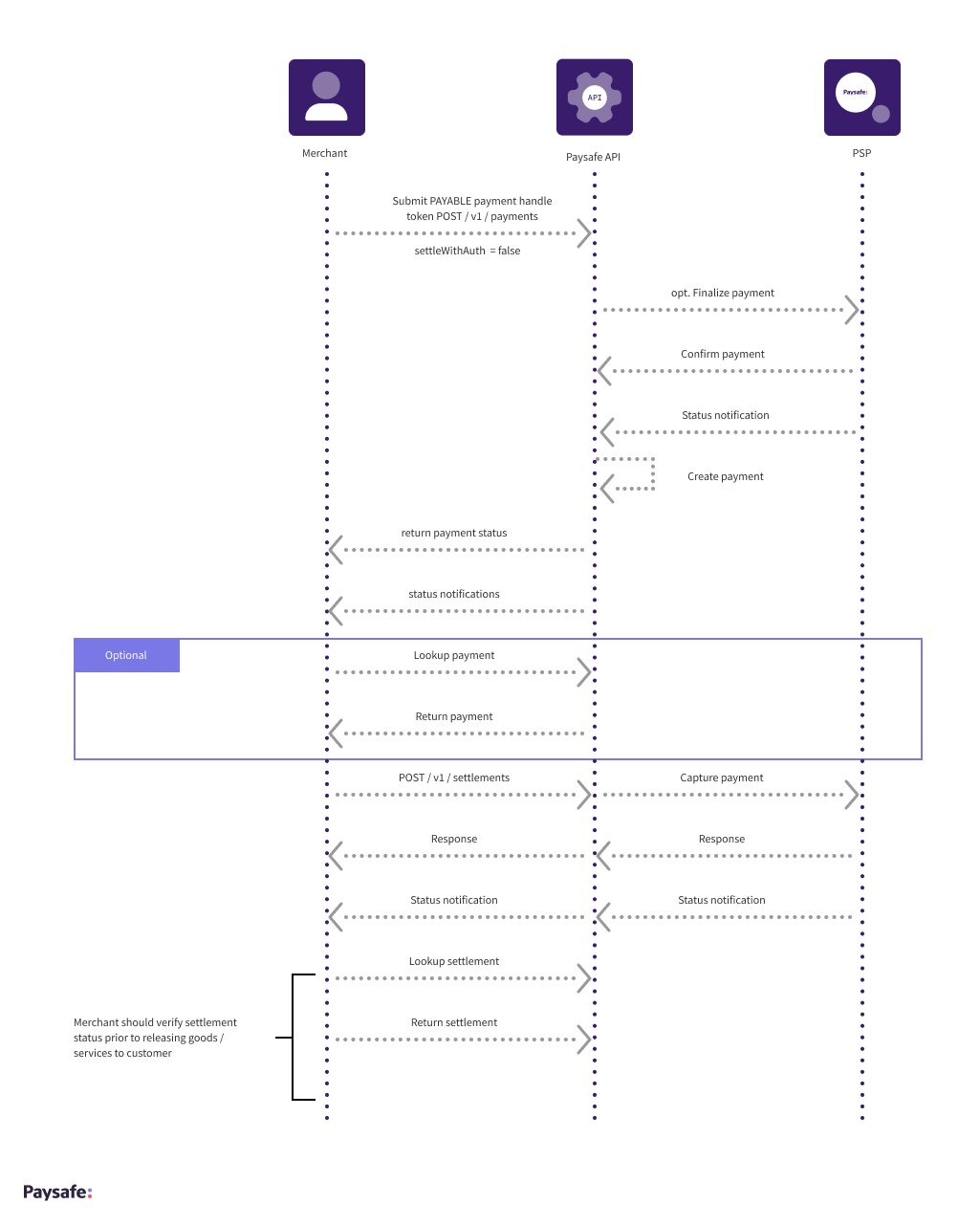

Two-step payment gateway refers to payment integrations, where the authorization (Payment) and capture (Settlement) are performed as two unique steps.

- May support both settleWithAuth=true and settleWithAuth=false options.

- Paysafe may optionally offer auto settlement and support the settleWithAuth=true option (dependent upon the payment type). In this scenario, Paysafe will attempt to issue the settlement calls on your behalf. For these integrations, the Payment status is used to reflect if the customer's request has been authorized with the PSP. For these integrations, regardless of whether manual or automatic settlement is selected, the merchant must separately check the status of the Settlement to confirm funds have been appropriately transitioned before releasing goods/services to the customer.