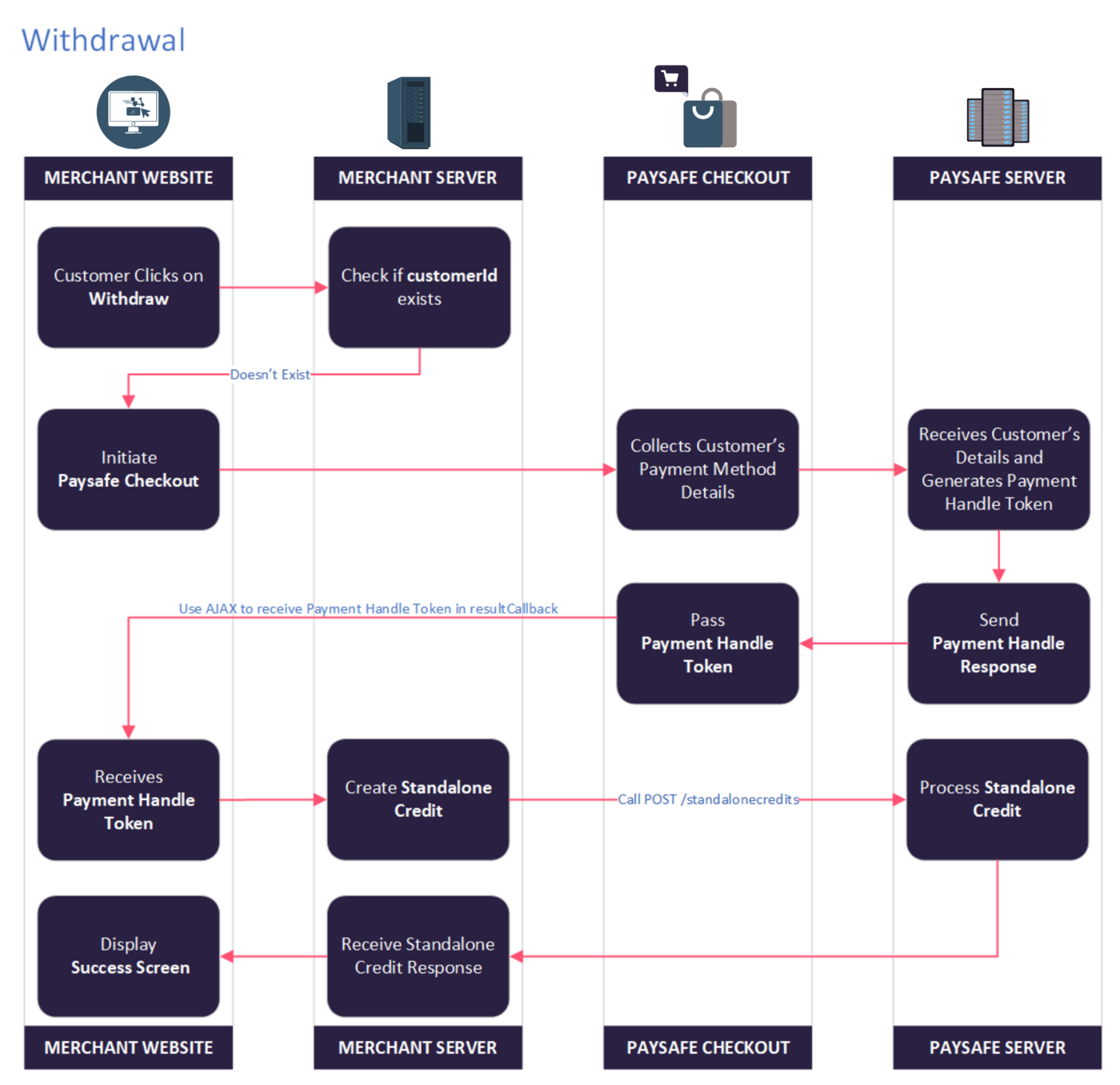

Process Withdrawals

Paysafe Checkout enables you to send money back to your customers’ Cards, Bank accounts or Wallets.

-

The Customer initiates the withdrawal.

-

Merchant Server checks if the customer profile is already created at Paysafe.

-

The merchant website initiates the Checkout with setup options.

-

Paysafe Checkout collects Customer’s payment method details.

-

Paysafe server receives the customer details and sends the Payment Handle Response to the Paysafe Checkout.

-

Paysafe Checkout sends the Payment Handle Token to Merchant Website as a part of resultCallback.

-

Merchant website sends the Payment Handle Token to the Merchant server.

-

Merchant server calls the Standalone Credit API using the private key. You must initiate a POST request to the endpoint:

POST/paymenthub/v1/standalonecredits

-

Standalone Credit API processes the request and returns the response.

-

Merchant Server processes the Standalone Credit Response.

-

Merchant Website displays Success screen on the Merchant website.

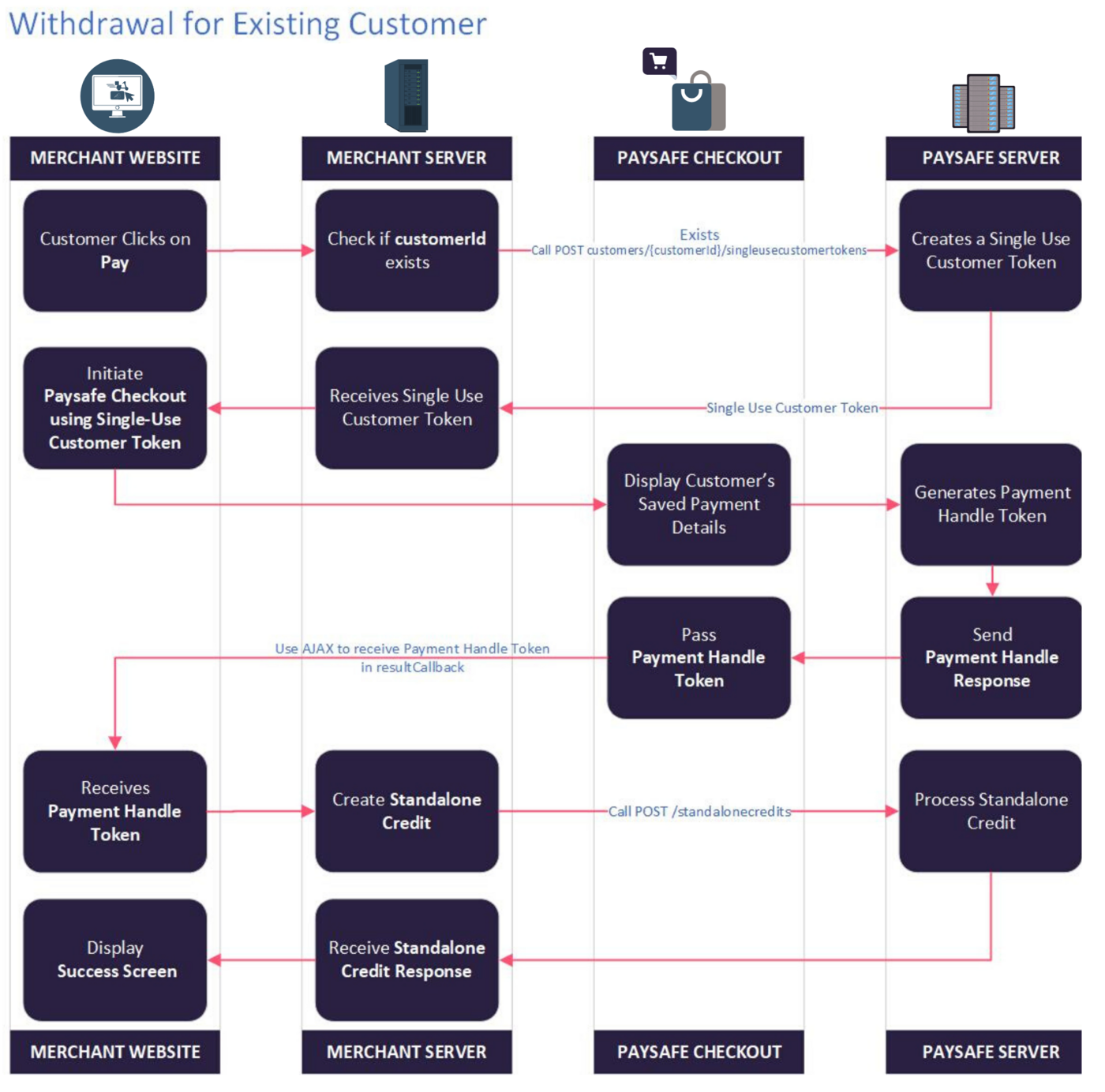

Here is a typical Scenario for an existing customer making a card withdrawal:

-

The Customer initiates the withdrawal.

-

Merchant Server checks if the customer profile is already created at Paysafe.

-

If the customerId exists, the merchant server makes an API call to create a single-use customer token API using the customerId.

-

The Paysafe server generates and sends the single-use customer token to Merchant Website.

-

Merchant Website initiates the Paysafe Checkout using the single-use customer token.

-

Paysafe Checkout displays the Customer’s saved payment details.

-

Paysafe server generates and sends the Payment Handle Response to the Paysafe Checkout.

-

Paysafe Checkout sends the Payment Handle Token to Merchant Website as a part of resultCallback.

-

Merchant website sends the Payment Handle Token to the Merchant server.

-

Merchant server calls the Standalone Credit API using the private key. You must initiate a POST request to the endpoint:

POST/paymenthub/v1/standalonecredits

-

Standalone Credit API processes the request and send the Standalone Credit Response.

-

Merchant Server processes the Standalone Credit Response.

-

Merchant Website displays Success screen on the Merchant website.

The following code sample shows a minimal Paysafe Checkout example that creates a payment overlay for the user. The overlay contains a Payment button that creates a payment handle for the data entered by the user and displays the payment handle token (if successful) in the browser console.

Paysafe Checkout Code Sample

<!DOCTYPE html>

<!-- Sample Paysafe Checkout Code https://developer.paysafe.com

Please feel free to copy this code to a fresh HTML file, and run it on your device (all desktop and mobile devices are supported).

You may even use this code as baseline to integrate your website with Paysafe & start receiving online payments. -->

<html>

<head>Paysafe Checkout Demo

</head>

<body>

<button onclick="checkout()"> Paysafe Checkout </button>

</body>

<script src="https://hosted.paysafe.com/checkout/v2/paysafe.checkout.min.js"></script>

<script type="text/javascript">

var API_KEY_MERCHANT_TEST = "<Please-Insert-Your-Base64-Encoded-API-Key-Here>";

function checkout() {

paysafe.checkout.setup( API_KEY_MERCHANT_TEST, {

currency: "USD", // 4 currencies currently supported by Paysafe Checkout - "USD", "CAD", "EUR", "GBP"

amount: 10000, // This qualifies as USD $ 100.00. Multiply Payment Amount by 100 and supply here.

payout: true, // payout: true --> for Withdrawal (standalone credits); payout: false --> for Payments/Deposit

payoutConfig: { // payoutConfig section required only when payout: true [for Withdrawal cases].

"maximumAmount": 100000000

},

locale: "en_US",

simulator: "EXTERNAL",

imageUrl: "https://hosted.paysafe.com/checkout/resource/demo-store/images/logo.png", // Supply Your Logo URL here.

environment: "TEST", // environment: "LIVE" --> Production, "TEST" --> test environment for customers to try out Checkout & its features

buttonColor: "#66cc99", // feel free to change the color of buttons (RGB value)

companyName: "Example Paysafe Merchant", // Supply Your Company Name here

holderName: "John Smith", // Supply Customer's Name here

customer: {

firstName: "John",

lastName: "Dee",

email: "johndee@paysafe.com",

phone: "1234567890",

dateOfBirth: { // dateOfBirth : This {section} is optional, needs to be provided only if you want to prefill DOB in Checkout.

day: 1, // If dateOfBirth : {section} is not supplied, Checkout will allow the customer to enter his DOB before Payment.

month: 7,

year: 1990

}

},

billingAddress: { // Supply customer's billing Address here.

nickName: "John Dee",

street: "20735 Stevens Creek Blvd",

street2: "Montessori",

city: "Cupertino",

zip: "95014",

country: "US",

state: "CA"

},

merchantRefNum: "Supply Merchant Ref Num Here. (Unique For Every Transaction)", // Will be unique and must keep changing every transaction

canEditAmount: true, // Makes the payment amount editable on Checkout screen. Make it false to open Checkout with a fixed non-editable amount.

merchantDescriptor: {

dynamicDescriptor: "XYZ",

phone: "1234567890"

},

displayPaymentMethods: ["neteller", "skrill", "paysafecard", "paysafecash", "instantach", "paypal", "card", "vippreferred", "sightline", "ach", "eft"],

// displayPaymentMethods : Array serves two purposes. You can use it to restrict the payment methods that a customer can see.

// You can also use it to order the payment methods based on your preference.

// If this field is present, the customer will only see those payment methods in the order specified, hence,

// Ensure that you provide all payment methods if you are using it only for the purpose of payment method ordering.

paymentMethodDetails: { // Please read the Checkout Objects Documentation on developer.paysafe.com .....

paysafecard: { // .... for details on paymentMethodDetails (including all supported mandatory and optional fields)

consumerId: "123456"

},

paysafecash: {

consumerId: "123456"

},

sightline: {

consumerId: "12341231256",

SSN: "123456789",

last4ssn: "6789",

//accountId: "1009688222" // Supply Account ID only if multiple accounts are configured with same payment method

},

vippreferred:{

consumerId: "120288765",

//accountId: "1679688456" // Supply Account ID only if multiple accounts are configured with same payment method

},

card: {

//accountId: "1009688230" // Supply Account ID only if multiple accounts are configured with same payment method

},

skrill: {

consumerId: "greg_neteller@mailinator.com",

emailSubject: "Payout for Greg Neteller",

emailMessage: "You Have Received Payout of $100."

},

instantach: {

consumerId: 'john.doe@email.com',

paymentId: '3aeb9c63-6386-46a3-9f8e-f452e722228a',

emailSubject: 'Instant ACH Payout',

emailMessage: 'Your Instant ACH Payout request has been processed'

},

neteller: {

consumerId: "netellertest_EUR@neteller.com",

recipientDescription: "logo_url_alt_text",

logoUrl: "http://www.paysafe.com/icon.jpg"

}

}

}, function (instance, error, result) {

if (result) {

alert(JSON.stringify(result, null, 4));

} else {

alert(error);

}

if (result.token) {

alert("Payment Token (Returned By Paysafe GW): " + result.token);

if (result.paymentMethod == "Cards") {}

if (result.paymentMethod == "DirectDebit") {}

if (result.paymentMethod == "Interac") {}

}

}, function (stage, expired) {

alert ("Payment Handle Stage :: " + stage);

switch (stage) {

case "PAYMENT_HANDLE_NOT_CREATED": // Handle the scenario

case "PAYMENT_HANDLE_CREATED": // Handle the scenario

case "PAYMENT_HANDLE_REDIRECT": // Handle the scenario

case "PAYMENT_HANDLE_PAYABLE": // Handle the scenario

default: // Handle the scenario

}

});

}

</script>

</html>