Overview

- Payments

- Canada

- United States

- Legacy

Please note: This solution is currently available to Platform Partners in North America only.

Paysafe Group Card Payments contain the following two categories of transactions:

Card Not Present

Paysafe offers a flexible set of API for processing card payments using the Paysafe platform. Connect your application directly to our payment platform to process a full suite of methods that are REST-based – designed to be easy to understand and use.

- Choose an efficient, lightweight, and fast integration method to access our API.

- Implement a variety of REST-based API requests – including purchases, refunds, and voids (authorization reversals).

- Obtain output in JSON format – it’s easy to parse in web and mobile applications.

- Use any language or platform to make requests through standard HTTP protocols.

Along with payment processing, Paysafe also provides a full array of associated services, including risk management, fraud reduction, and online real-time reporting tools.

Payments Made Easy

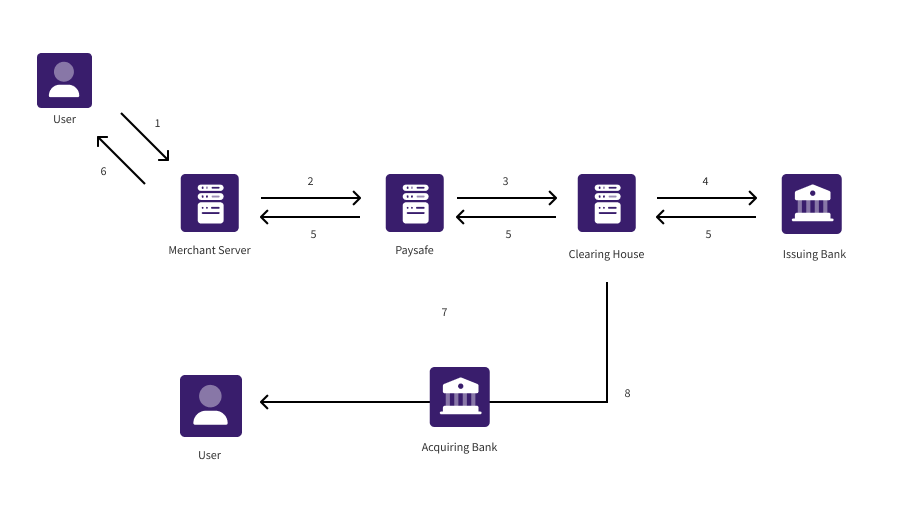

Paysafe's end-to-end payment solution enables businesses of any size to accept payments through a single integration. Here is a summary of the process:

- The customer places an order on the merchant's website.

- The merchant sends a transaction request, including card information and a purchase amount, to Paysafe.

- Paysafe processes the transaction and sends an authorization request to the issuing bank (customer's bank).

- The issuing bank verifies the cardholder's information and authorizes the purchase amount.

- Paysafe returns the response to the merchant.

- The merchant provides a response to the customer.

- The acquiring bank credits the Paysafe account held on behalf of the merchant. This is when the initial authorization is settled.

- The customer's card account is charged.

Merchants can log in to their accounts to look up any transaction processed with Paysafe, including authorizations, settlements, refunds, or cancellations.

Start Accepting Card Payments

Your Paysafe account provides access by default to Visa and Mastercard debit and credit cards. You can create separate Paysafe accounts to support other well-known card brands, such as Amex, Diners and JCB. Please contact us for details.

Once you have set up a Paysafe merchant account, you can connect to the Paysafe payments platform with our simple-to-use API. See our Scenarios section for a quick overview of integration options when using the API.

To download a French version of this guide in PDF, click here.

Please contact us for more information on services offered by our own Paysafe Acquiring.

Card Present

A transaction is considered a “card present” if payment details are captured in person at the time of the sale. In these transactions, cards are physically swiped, tapped, or dipped through a reader, or an EMV chip is processed. These transactions are considered more secure than card-not-present transactions since a merchant can view the buyer, the card, and its signature.

The following are some of the benefits of card-present transactions:

-

Reduces risks and costs per transaction.

-

Better security during transactions for both businesses and consumers as the card doesn’t leave the customer’s hand

-

Less fraud

-

Better Liability during transactions

Paysafe omnichannel payments platform is a comprehensive solution for payment processing offering our ISVs the flexibility to build robust point of sales systems to meet merchant needs across all payment channels. From in store payments, ecommerce, to subscription businesses, to platforms and marketplaces, we offer a complete API stack for all your payments needs across channels.

With Paysafe Omnichannel API stack, the ISV is able to build innovative POS systems where their merchants are able to sell everywhere the customers are, and manage everything right in Paysafe portal.

Paysafe omnichannel platform supports and simplifies operations for greater efficiency, speeding up the deployment of new payment methods across markets, giving more opportunities for growth and innovation.