Overview

- Onboarding

- Canada

- United States

- Latest

Applications API allows platform partners to create their own white-labelled merchant onboarding experience, using a single REST-based API call. You can tailor your user experience to your business, using client information you have already collected and verified. Additionally, you can use Batch Applications API for onboarding merchants in bulk, and our Account Migration Toolkit to migrate and onboard your existing customers to Paysafe.

After receiving a merchant application, Paysafe quickly enables the merchant for the selected payment methods. The result of the improved user experience will be higher onboarding conversion rates, leading to increased processing volumes.

Features

- Customize your user experience for merchant onboarding while Paysafe's Applications API provides the complete suite of auto-adjudication and automated onboarding capabilities.

- Onboarding multiple accounts with a single create call, for example applying for credit card and ACH at once.

- Take advantage of Paysafe's automated onboarding verification services for 3rd party vendor checks.

- In a single application request, your merchants can apply for:

- Multiple locations

- Multiple payment methods

- Multiple currencies for each payment method

- Use any programming language or platform to make requests through standard HTTP protocols.

- Get notified of the application status updates by subscribing to webhook notifications.

Setup Requirements

Before you can start using Applications API, ensure the following:

- You have a platform partner account in sandbox or production.

- You have API Authentication credentials.

- To get both of them, reach out to integrations@paysafe.com.

Before starting your integration, we suggest to have a look at Standard Account Hierarchy Model.

The mandatory fields you need to fill out will be affected by the different regulatory frameworks in North America and Canada. Each API request details the mandatory and optional fields.

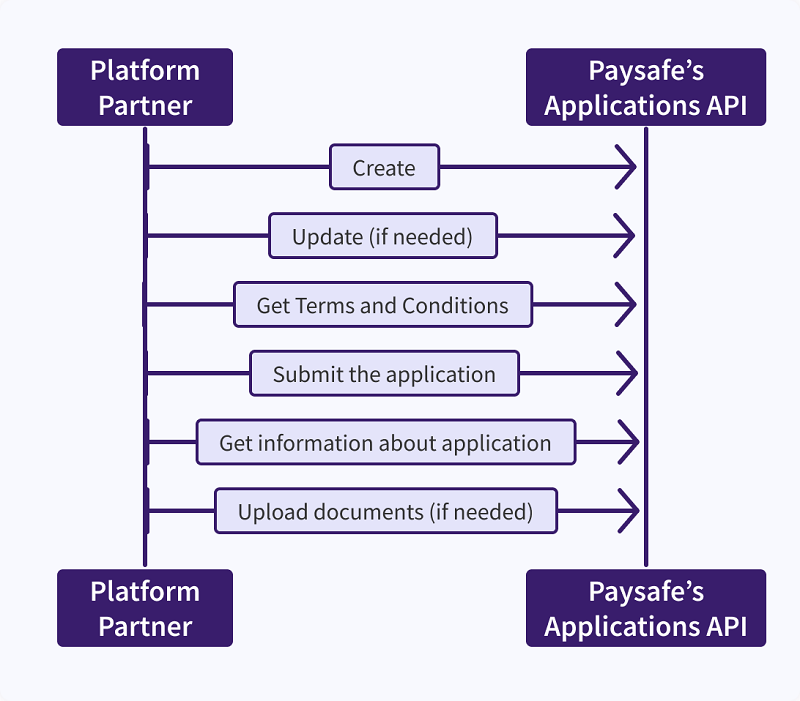

- Create Initial Application (POST /merchant/v1/applications)

- This will create a new application request (onboard a new account) and need to complete the steps below to submit the app.

- Update (optional - PUT /merchant/v1/applications/{appId})

- This is an optional call, in case you need to update something.

- Get Terms and Conditions (GET /merchant/v1/applications/{appId}/termsandconditions)

- Get terms and conditions call returns the Paysafe's terms and conditions that the merchants must accept in order to begin processing their transactions.

Note: The response header X-TERMS-VERSION should be copied to termsVersion while submitting an application.

- Get terms and conditions call returns the Paysafe's terms and conditions that the merchants must accept in order to begin processing their transactions.

- Submit the application (PATCH /merchant/v1/applications/{appId})

- Submit application call allows you to send an application request to Paysafe for review, from this point onwards it is no longer possible to modify it via the API.

- Upload Documents (optional – POST /merchant/v1/applications/{appId}/documents)

- Upload documents through an API call. Submit the documents along with the application or even after the application is submitted. For more details, see API reference.

- You can upload a pre-configured list of documents before submitting an application, this will help to expedite the application approval process.

- You can upload documents requested by credit underwriter after application is submitted and is in review state. When a new document is requested from credit underwriter a webhook notification is triggered to the partner configured URL.