Getting Started

Skrill Crypto On-Ramp flow

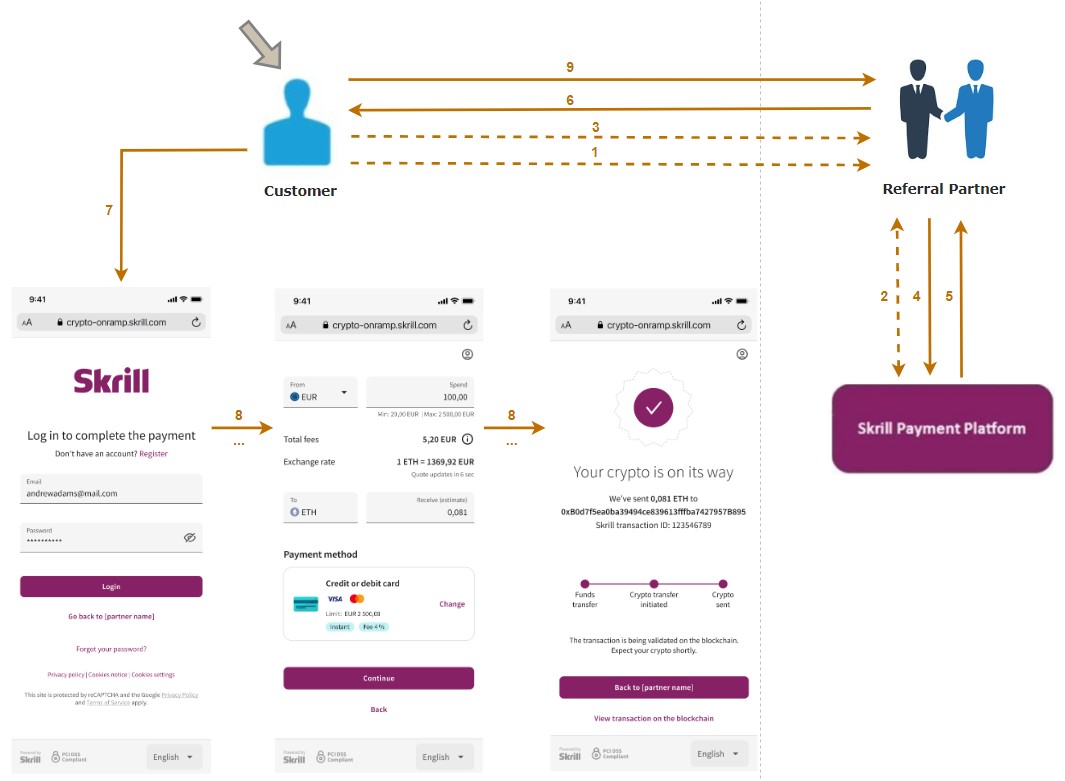

An illustration of the Skrill Crypto on-ramp flow:

Skrill partners have two options to integrate:

- Option 1: Redirect Link + Quoting service - when partners want to display a quote to their customer within their own interface.

- Option 2: Redirect Link only – the quickest way to integrate the Skrill Crypto on-ramp. Simply display the Skrill Crypto on-ramp in your interface and let us take care of the rest.

The following table shows the actions customers take in their journey bases on the diagram above:

| # | Action | Redirect Link + Quoting service | Redirect Link only |

|---|---|---|---|

| 1 | Customer logs into your application and completes the steps that lead to getting quotes from different providers | Required | N/A |

| 2 | You request generation of quotes from Skrill and display them in the providers list | Required | N/A |

| 3 | Customer chooses Skrill from listed trusted providers with offered quotes | Required | N/A |

| 4 | You request a session identifier (SID) by passing the required crypto purchase details to Skrill | Required | Required |

| 5 | Skrill validates the provided details and returns the generated SID alongside a redirect link | Required | Required |

| 6 | You redirect the customer to Skrill Crypto on-ramp using the received redirect link displaying the Skrill Crypto on-ramp screen | Required | Required |

| 7 | The customer logs into their Skrill account using their credentials or proceeds to registration if they are a new customer | Required | Required |

| 8 | From now on the crypto purchase journey of the customer is entirely through Skrill’s crypto on-ramp solution. The customer will be guided through multiple steps of verification and confirmation of the purchase until the transaction is completed and the crypto is delivered to the customer’s crypto wallet address | Required | Required |

| 9 | After the transaction is completed, the customer can go back to your landing page | Required | Required |

NOTES:

- The customer is fully onboarded as a Skrill customer and accepts Skrill’s Terms and Conditions.

- Skrill owns the customer journey inclusive of customer support.

- The customer needs to be KYC verified to complete the transfer. Newly registered customers will have to verify their identity and address before proceeding with their first transaction. Our KYC service supports IP Geolocation to minimize friction.

Display Skrill Crypto On-Ramp logos

In both integration options, Skrill partners need to display the Skrill Crypto logos as reference to the service provided by Skrill.

Download a copy of this logo in different sizes from the Skrill Website.

Integration Basics

Skrill offers an easy-to-integrate solution. You can find below a brief description of the endpoints included in our API.

| Endpoint | Short Description |

|---|---|

| Get Quotes | Allows partners to generate quotes and provide quote summary details on partner websites. |

| Secure Session Initialization | Redirects end-customers to Skrill to execute their payment, based on the payment method they selected. |

| Supported cryptocurrencies | The supported Cryptocurrencies and networks in the On-Ramp product. |

| Supported countries, payment methods and fiat limits | Detailed information per country for the supported payment methods & fiat limits. |

Fee Transparency

Skrill Crypto On-Ramp fees are fully transparent. We display full quote breakdown in both the quote service and following session initialization. Skrill does not add spread to crypto exchange rates.

For partners who want to earn commission through their integration we have configurable fee shares.

As everything else in the Skrill Crypto on-ramp, this follows our transparency principle and will be displayed to customers.

The types of fees we might charge are fully detailed on the API page.

Security

Each authorized partner will be invited to the Skrill Business Portal and requested to set up Secret Word for their integration. When requesting a secure payment session initialization, you will be expected to sign the request using a Signature.

The Signature represents a hashed version of the Secret Word and a set of request parameters from your session initialization request. The default hashing algorithm Skrill uses is SHA-256. For more information, check the API docs.

By using a signature in starting a payment session, we guarantee that the information we use is trusted and it is generated by you (an authorized Skrill partner) when calling our REST API. This level of security makes it impossible for a malicious party to generate the payment session, since there is no way for a third party to know which secret is used by you.

Reporting

Skrill provides financial reporting to Authorized partners who are entitled to receive fee shares (fee type: SHARED). This happens through the Skrill Business Portal. Each partner will be able to check their accumulated amount, and the consumer transactions from which they are initiated.

Real-time consumer transaction data reporting is offered through a Webhook service. Each partner willing to receive such notifications will need to whitelist the domain where they will receive them. The exact URL can be changed at any time, and this information should be passed with the secure payment session initialization request.

Skrill sends notifications for transaction initiation, Risk Check status, and failure or success of a transaction. Upon successful transaction, partners will receive detailed information about the final transaction amount, as well as the blockchain transaction hash.

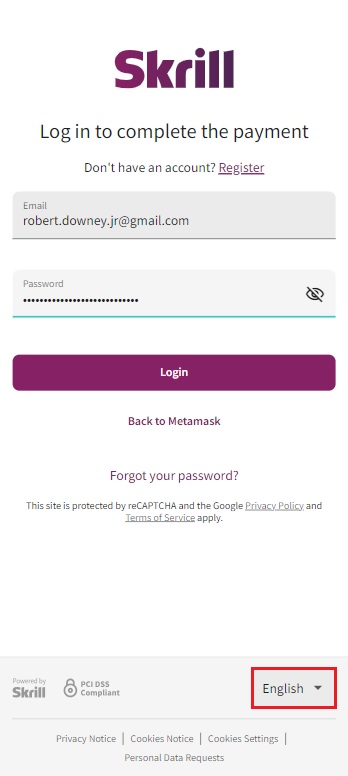

Languages

Skrill offers the On-Ramp services in several languages (check the table below)

English will be displayed by default for first-time customers. For returning customers, we would preserve their last selection (if they use the same browser and have not deleted their history/cache). Partners can enrich the URL they pass to consumers with the chosen locale. To do so, use the abbreviation listed in the table below.

Note: Be aware that previous customer selection has precedence over sending the locale through URL.

| Language | Locale abbreviation |

|---|---|

| English | en |

| Czech | cz |

| Spanish | es |

| French | fr |

| Italian | it |

| Greek | gr |

| Polish | pl |

| Portuguese | pt |

| German | de |

Testing & Onboarding

Prospects can test the integration at any time. Most of the endpoints are available to test without the need for further authorization. In order to test the Secure Payment Initialization requests, our pre-sales team will give you test partner account credentials. User flow tests are possible through a demo form.

Once a partner decides to integrate, they will undergo a due diligence process to get onboarded as a Skrill Partner. Our sales team will help you get through this process and explain what will be required at each step. A general overview of the onboarding steps is provided below. Production traffic can be released as soon as technical integration and onboarding is completed.

- Prospect submits an Onboarding Application form

- Skrill completes due diligence on the prospect

- Contract Signature

- Technical integration & Onboarding

After the onboarding process is finished, you will have your own account in the Skrill Business Portal that you can operate with.