Creating Account Updater Files

Account Updater files are CSV files that you upload to the Paysafe SFTP site. Your CSV file can contain records for one or more merchant accounts, provided you are the rightful owner of these accounts.

This topic describes:

Formatting your file

Your CSV file must conform to the following:

- Have no spaces between values.

- Each line (record) in the file must contain the data for one Account Updater query only.

- The values in each record must be those specified in Account Updater File Fields and in the same order as they are listed.

- The maximum size of an Account Updater file is 1 MB.

- For optimal performance, each Account Updater file should be no larger than 3MB or 50,000 records.

If any record in the uploaded file contains an error, e.g., a missing field, no part of file will be processed and you will receive an acknowledgment file from Paysafe, listing which records are in error so you can correct them and upload the file again.

Naming your file

You must use the following convention for naming your Account Updater file:

upd_<YourUniqueFilename>.csv

For example:

upd_00001.csv

Your file name should consist of alphanumeric characters and underscores only. Do not use special characters, such as dashes, spaces, or quotation marks, when naming your file. If you do not name your file in this way it will not be processed.

Once the file is encrypted (see Encrypting your Account Updater files), the file name gets a .gpg extension; for example:

upd_00001.csv.gpg

Account Updater file fields

The following table describes the fields that must be included in each record in the Account Updater file. Apart from Store ID and Store Password, which are optional, you need to supply all the fields for all record identification methods, except for the Expiry Date and Card Type, which are only required when you use the credit card number. If you omit the Store ID or Store Password you must still include the blank field, with the necessary commas, in your records.

| Field | Description |

|---|---|

| FMA | Your Paysafe merchant account number. Up to 10 digits. |

| Store ID | Your Paysafe store ID; provided by Paysafe during integration, this is used to authenticate your request. Up to 80 characters. Optional, but if you leave the field blank, you must still include the necessary commas. |

| Store Password | Your Paysafe store password; provided by Paysafe during integration, this is used to authenticate your request. Up to 20 characters. Optional, but if you leave the field blank, you must still include the necessary commas. |

| Record Value | A record identifier, which is one of these:

|

| Expiry Date | Needed only when you use a credit card number. The credit card expiry date in the format MMYY. |

| Card Type | Needed only when you use a credit card number. The credit card brand, which is either

|

| Record Types | The type of record you are inquiring about. Either:

|

Credit card

This record contains a credit card number and expiry date:

99980369,my_store_ID,my_store_pwd,4445999999999997,1221,VI,CARD

Credit card no merchant credentials

The following is an example of a valid record that does not contain the store ID or store password:

99980369,,,4445999999999997,1212,VI,CARD

If you are omitting the value for an optional field, you must still include a place for that field, offset with commas (for example, value,value, , ,value).

NETBANX Ref. ID

This record contains a NETBANX Ref. ID:

99980369,my_store_ID,my_store_pwd,261NQJ7QSZ0VEOL1LP,,,NBX

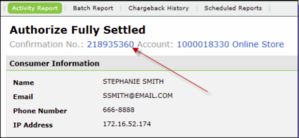

Confirmation Number

This record contains a confirmation number:

99980369,my_store_ID,my_store_pwd,219413540,,,CONF