Use Case 1: Payments

This use case enables your consumer to choose Pay by Bank as a payment option on your webstore and to make a payment using their bank account.

To understand the next steps here, it is important to understand the difference between a new and returning consumer.

-

A new consumer is defined as a consumer that has never used Pay by Bank (US) via Paysafe.

-

A returning consumer is defined as a consumer that has used Pay by Bank (US) via Paysafe – either with you, or another merchant.

It is important to understand the distinction between the two because both the consumer journey and merchant integration differ for each type of consumer.

-

For a new consumer, there is a process to first link the consumer's bank account to make a Pay by Bank (US) payment. This involves redirecting the consumer to their bank.

-

For a returning consumer, the bank account is already linked and stored by Paysafe. There is therefore no need to redirect the consumer to their online banking. The consumer selects their linked bank account from a list presented by the merchant and this information is passed to Paysafe.

Implementation

Call the following endpoints in sequence:

-

/paymenthub/v1/paymenthandles

(transactionType: VERIFICATION)

Initializes the verification process, which determines whether this is a new or returning consumer. This is a mandatory step in order to complete the subsequent steps.- Returning consumer: proceed to step 2 to get the list of bank accounts.

- New consumer: proceed to step 3 in order to create a payment and subsequently register the new consumer.

-

/paymenthub/v1/verifications

Returns the list of bank accounts linked to the consumer. This is a mandatory step in order to ensure that you have the most recent and up-to-date list of bank accounts to present to the consumer on your webstore.

-

/paymenthub/v1/paymenthandles

(transactionType: PAYMENT)

Initializes the payment process.-

New customer: provides you with a URL to redirect the consumer to link their bank account.

-

Returning consumer: you submit the token representing the bank account chosen by the consumer (pass payByBank.ach.paymentHandleToken) when on the merchant webstore. You then redirect the consumer to a third party page to view the payment outcome.

-

-

/paymenthub/v1/payments

Call the payments endpoint to capture the payment within 15 minutes - after this, the payment handle expires and the request to debit the consumer's bank account is not submitted.

NOTE: For code examples and detailed explanations of the parameters, refer to the Payments API Reference.

-

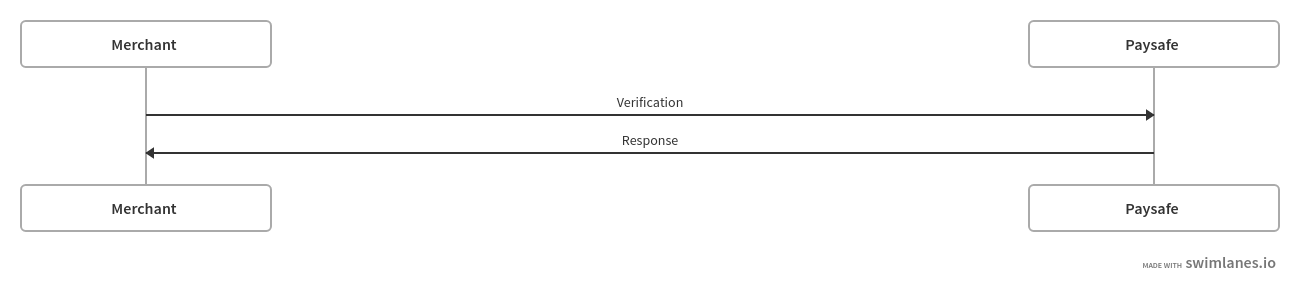

Call endpoint /paymenthub/v1/paymenthandles

- transactionType: VERIFICATION

- paymentType: PAY_BY_BANK

-

Pass the required parameters in the payByBank object.

-

If this is a new consumer, pass the required parameters in the billingDetails and profile objects.

-

Paysafe creates a payment handle and returns our standard gateway response, indicating either a positive or negative outcome:

Happy path: this is a returning consumer

Outcome Paysafe

HTTP

Status CodeLPM Error

Code/ MessageCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThe consumer

exists in Pay

by Bank.201

YES

Submit any

consumerId

that you have

already linked.PAYABLE

Go to step 2 to

retrieve the array

of bank accounts

for the consumer.Happy path: this is a new consumer

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThis is a new

consumer who

has not previously

used Pay by Bank.201 USER_NOT_EXIST YES Submit any

consumerId

that you have

not already

linked.FAILED Go to step 3

to link a bank

account for

the consumer. -

The payment handle status depends on the outcome of the request:

- For positive scenarios, the payment handle is created with status PAYABLE.

- For negative scenarios, the payment handle is created with status FAILED.

-

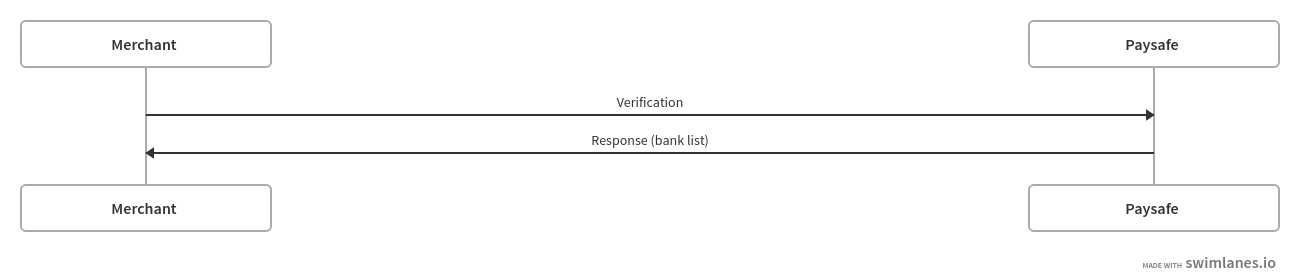

Call endpoint /paymenthub/v1/verifications using the paymentHandleToken.

-

The payment handle status changes to COMPLETED.

-

-

Paysafe returns our verifications response, indicating that the request status is COMPLETED and providing a paymentHandleToken for each registered bank account.

-

Store the token (payByBank.achBankAccounts.paymentHandleToken) for later use.

payByBank.achBankAccounts.paymentHandleToken is a unique identifier for each bank account of the consumer and does not change. You subsequently use it to create a single-use payment handle token, which is used to make payments and withdrawals for each unique transaction.Happy path: Paysafe returns the consumer's linked bank accounts

Outcome Paysafe

HTTP

Status CodeLPM Error

Code/ MessageCan be

simulated?How to

simulate?Payment

handle

statusNext

actionPaysafe returns a

list of up to 4 linked

bank accounts for

the existing

consumer.201

YES

Submit any

consumerId

that you have

already linked.COMPLETED

Go to step 3 to

initiate payment

using the selected

bank account.

-

Call endpoint /paymenthub/v1/paymenthandles

- transactionType: PAYMENT

- paymentType: PAY_BY_BANK

-

If this is a new consumer, pass the required parameters in the payByBank, profile and billingDetails objects.

-

Paysafe creates a payment handle and returns our standard gateway response, indicating either a positive or negative outcome:

Happy path: the returning consumer initiates payment

Outcome Paysafe

HTTP

Status CodeLPM Error

Code/ MessageCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThe returning

consumer initiates

payment with

Pay by Bank,

using their linked

bank account.201

YES

Submit consumerId and

ach.paymentHandleToken,

which you have already

linked.INITIATED

Go to step 4 to

redirect and

complete the

payment. -

The payment handle status depends on the outcome of the request:

- For positive scenarios, the payment handle is created with status INITIATED.

- For negative scenarios, the payment handle is created with status FAILED.

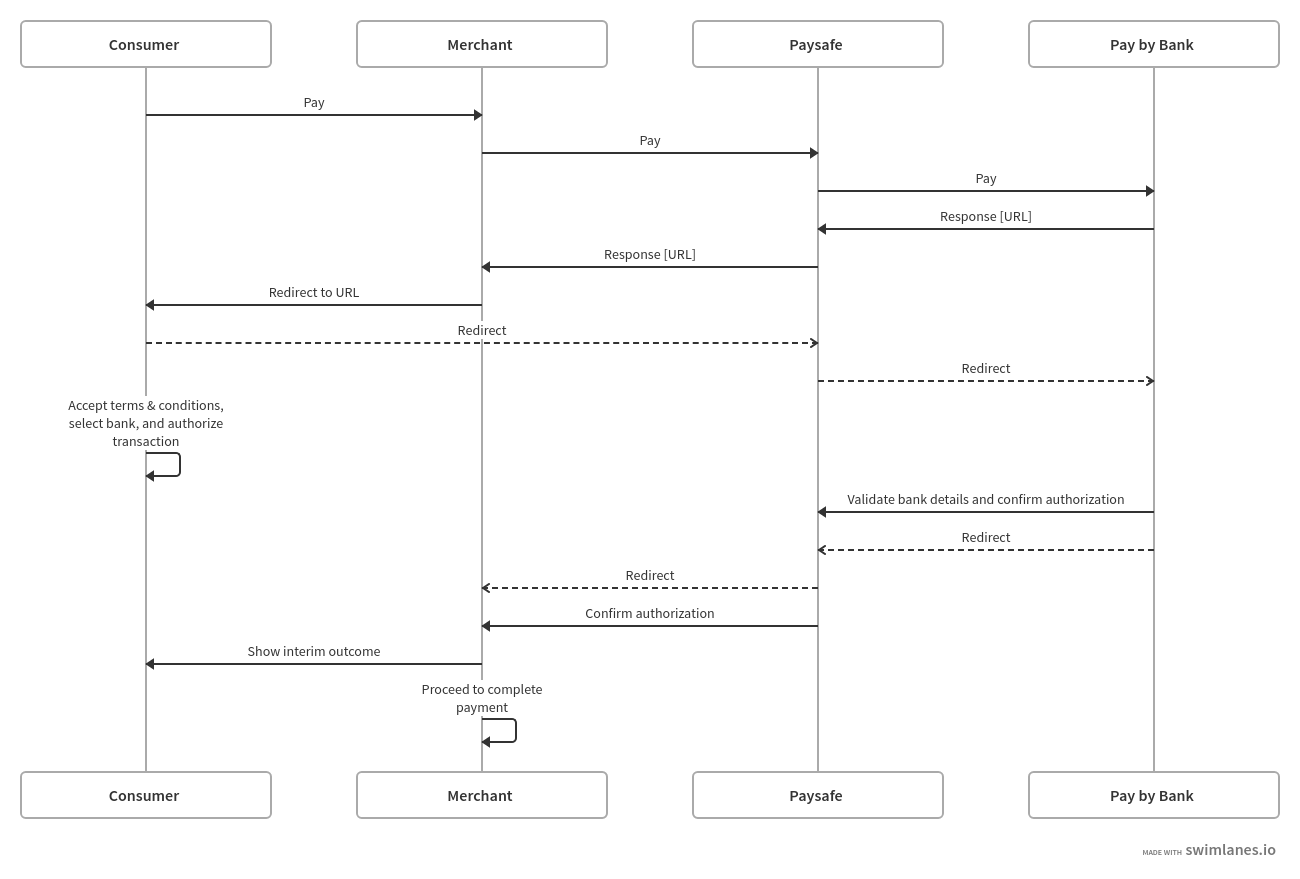

STEP 4: Redirect consumer

-

Redirect the consumer to the URL provided in the payment handle response.

- The payment handle status changes to PROCESSING.

-

The consumer accepts the Terms & Conditions (T&Cs), selects the bank they want to add, provides credentials and authorizes the transaction.

- The payment handle status changes to PAYABLE.

-

Paysafe returns our standard gateway response, indicating either a positive or negative outcome:

Happy path: Pay by Bank/ Paysafe approves the payment

Outcome Paysafe

HTTP

Status CodeLPM Error

Code/ MessageCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThe payment is

risk approved.YES

Submit a

transaction

with a value

of <1000.PAYABLE

Go to step 5 to

process the

payment.Unhappy path: Pay by Bank/ Paysafe declines the payment

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThe payment

is declined as

it is classified

as high-risk.YES Submit a

transaction

with a value

of >120,000.FAILED Unhappy path: the consumer rejects the Terms & Conditions (T&Cs)

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThe consumer

rejects the

T&Cs, so the

request fails.YES Do not

accept the

T&Cs on the

redirection

page.FAILED -

The payment handle status depends on the outcome:

- For positive scenarios, the status changes to PAYABLE.

- For negative scenarios, the status changes to FAILED.

-

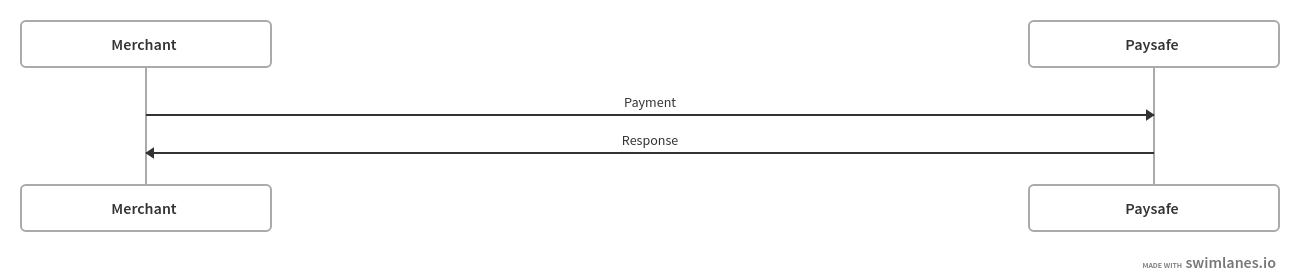

Call endpoint /paymenthub/v1/payments using the paymentHandleToken.

-

Paysafe returns our standard gateway response, indicating either a positive or negative outcome:

Happy path: the payment is successfully submitted for processing

Outcome Paysafe

HTTP

Status CodeLPM Error

Code/ MessageCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThe payment

is guaranteed.201

YES

Submit a

transaction

with a value

of <1000 and

select Custom

Account Ending

in 9828 on the

redirection page.COMPLETED

Unhappy path: the payment is not submitted for processing

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?How to

simulate?Payment

handle

statusNext

actionThe payment

fails as the

bank details

are invalid.201 The specified

bank and

account

information is

currently under

INVALID state.YES Submit a

transaction

with a value

of <1000 and

select ACHLink

Enr App/Trans

Decl - With

Transaction

History on the

redirection page.COMPLETED -

The payment handle status depends on the outcome of the request:

- For positive scenarios, the status changes to COMPLETED.

- For negative scenarios, the status changes to FAILED.

- For negative scenarios where the token expires after 15 minutes, the status changes to EXPIRED.

-

Following a successful payment, the consumer receives email confirmation of the payment.

NOTE: Pay by Bank is powered by Skrill USA, Inc. Skrill USA, Inc. is registered with FinCEN and duly licensed as a money transmitter in various U.S. states. As per regulations, transactions conducted through Pay by Bank are considered to be money transmissions, and therefore, an email notification must be sent to the consumer after a successful transaction. These emails are sent directly from Paysafe/Skrill to the consumer's registered email address.

Subsequent payments

To make subsequent payments for a consumer, use the paymentHandleToken that was added to their profile for the registered bank account (during the verifications step).

Subsequent payments are identical to the first payment apart from the following differences:

- As the consumer has already added banks to their profile, pass payByBank.ach.paymentHandleToken when calling the payment's payment handle (in step 3, above).

- The consumer is redirected to the Pay by Bank page and shown a confirmation if the transaction is approved or not. There is no redirection to the bank page.