Paysafecash

The Paysafe Payments API supports Paysafecash as a Payment Instrument. You can process paysafecash payments using the Payments API.

The Payments API caters to the following needs for Paysafecash:

- Payment Instrument: Paysafecash

-

Payment method: Online payments with cash

-

Transaction types: Payments

-

Payment authentication: API key for request authentication, Authorization of the payment server IP address, X.509 certificate for request authenticity

Paysafe Cash has limits imposed per transaction, which varies by country. Take a note of transaction limits as per your country of residence, mandated by local regulatory authorities and Paysafe.

| Paysafecash BAPPL | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Money-in | |||||||||||

| Customer Limits** | Distributor Limit | ||||||||||

| KYC - N/A | KYC - SDD | KYC - FDD | |||||||||

| Country | Country - ISO | Live? | Currency - ISO | Account? | Single | Single | Yearly | Single | Monthly | Min | Max |

| Austria | AT | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Belgium | BE | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Bulgaria | BG | Yes | BGN | Yes | €1000 | 4889 | €1000 | 4889 | |||

| Canada | CA | Yes | CAD | No | 3000 | 10 | 3000 | ||||

| Croatia | HR | Yes | HRK | Yes | €1000 | 19000 | €1000 | 19000 | 7 | 10000 | |

| Cyprus | CY | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | |||

| Czech_Republic | CZ | Yes | CZK | Yes | €1000 | 60000 | €1000 | 60000 | 1 | 50000 | |

| Denmark | DK | No | DKK | Yes | €1000 | 17500 | €1000 | 17500 | 0,10 | 7000 | |

| Finland | FI | No | EUR | Yes | 1000 | 2500 | 1000 | 2500 | |||

| France | FR | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Germany | DE | No | EUR | No | 1000 | 0,01 | 1000 | ||||

| Greece | GR | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Greece | GR | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Hungary | HU | Yes | HUF | Yes | €1000 | 650000 | €1000 | 650000 | 300 | 307000 | |

| Ireland | IE | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Italy | IT | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Latvia | LV | Yes | EUR | Yes | 1000 | €2500 | 1000 | 2500 | |||

| Lithuania | LT | Yes | EUR | Yes | 1000 | €2500 | 1000 | 2500 | 0,01 | 1000 | |

| Mexico | MX | Yes | MXN | No | €1000 | ||||||

| Netherlands | NL | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Norway | NO | No | NOK | Yes | €1000 | 17500 | €1000 | 17500 | |||

| Poland | PT | Yes | EUR | Yes | €1000 | 9000 | €1000 | 9000 | 0,04 | 4000 | |

| Portugal | PT | Yes | EUR | Yes | €1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Peru | PE | Yes | PEN | No | €1000 |

| |||||

| Romania | RO | Yes | RON | Yes | €1000 | 10000 | 1000 | 10000 | 4 | 4500 | |

| Slovakia | SK | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Slovenia | SL | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 1 | 1000 | |

| Spain | ES | Yes | EUR | Yes | 1000 | 2500 | 1000 | 2500 | 0,01 | 1000 | |

| Sweden | SE | Yes | SEK | Yes | €1000 | 20000 | €1000 | 20000 | |||

| Switzerland | CH | Yes | CHF | No | €1000 | 0,01 | 1000 | ||||

| United_Kingdom | GB | Yes | GBP | Yes | 1000 | 2000 | €1000 | 2000 | 0,01 | 499 | |

| USA | US | Yes | USD | No | €1000 | 10 | 500 * | ||||

Additional information:

-

Different distributor limits apply according to the applicable product. For more information please check - TESU - Paysafecash Product Separation - US - Paysafecard Operations - Paysafe Confluence

-

** Historical technical limitation to all countries on per transaction basis applies (the setting is done in config file / not admin). The limit is 1000 EUR per transaction. There are few exceptions: for USA – 999 USD/trx in general, in particular a dedicated limit for rent payments of 1500 USD and for Canada – 3000 CAD/trx

| Product | Minimum Barcode Amount | Maximum Barcode Amount |

|---|---|---|

| MDIRECTLOAD | 10 USD | 999 USD |

| IN_020_PAYSAFECASH | 10 USD | 500 USD |

| IN_019_PAYSAFECASH | 10 USD | 999 USD |

| IN_017_PAYSAFECASH | 10 USD | 500 USD |

| IN_015_PAYSAFECASH | 10 USD | 999 USD |

| IN_013_PAYSAFECASH | 10 USD | 1500 USD |

| IN_011_PAYSAFECASH | 10 USD | 999 USD |

| IN_009_PAYSAFECASH | 10 USD | 500 USD |

Typical Scenarios

Paysafecash Payment

When you want to process a payment request using Paysafecash as the payment type, you would do the following:

- Create a Payment Handle with the transactionType parameter set to PAYMENT and the paymentType parameter set to PAYSAFECASH.

- Since the customer has to complete payment authentication by providing Paysafecash details, Paysafe returns a response with the following:

- The action parameter is set to REDIRECT

- A payment_redirect link points to the Paysafecash redirect URL

- Redirect the customer to the Paysafecash redirect URL so they can generate a bar code.

- Upon successful bar-code generation, the status of the Payment Handle becomes PAYABLE. The merchant gets notified of this status change via webhooks that have been configured.

- Use the paymentHandleToken returned in the response to process the Payment request. The Payment will have a status of PENDING until the customer has made the payment.

Once the Payment request is successfully completed, the merchant gets notified via webhooks and the funds are immediately transferred to the merchant's account.

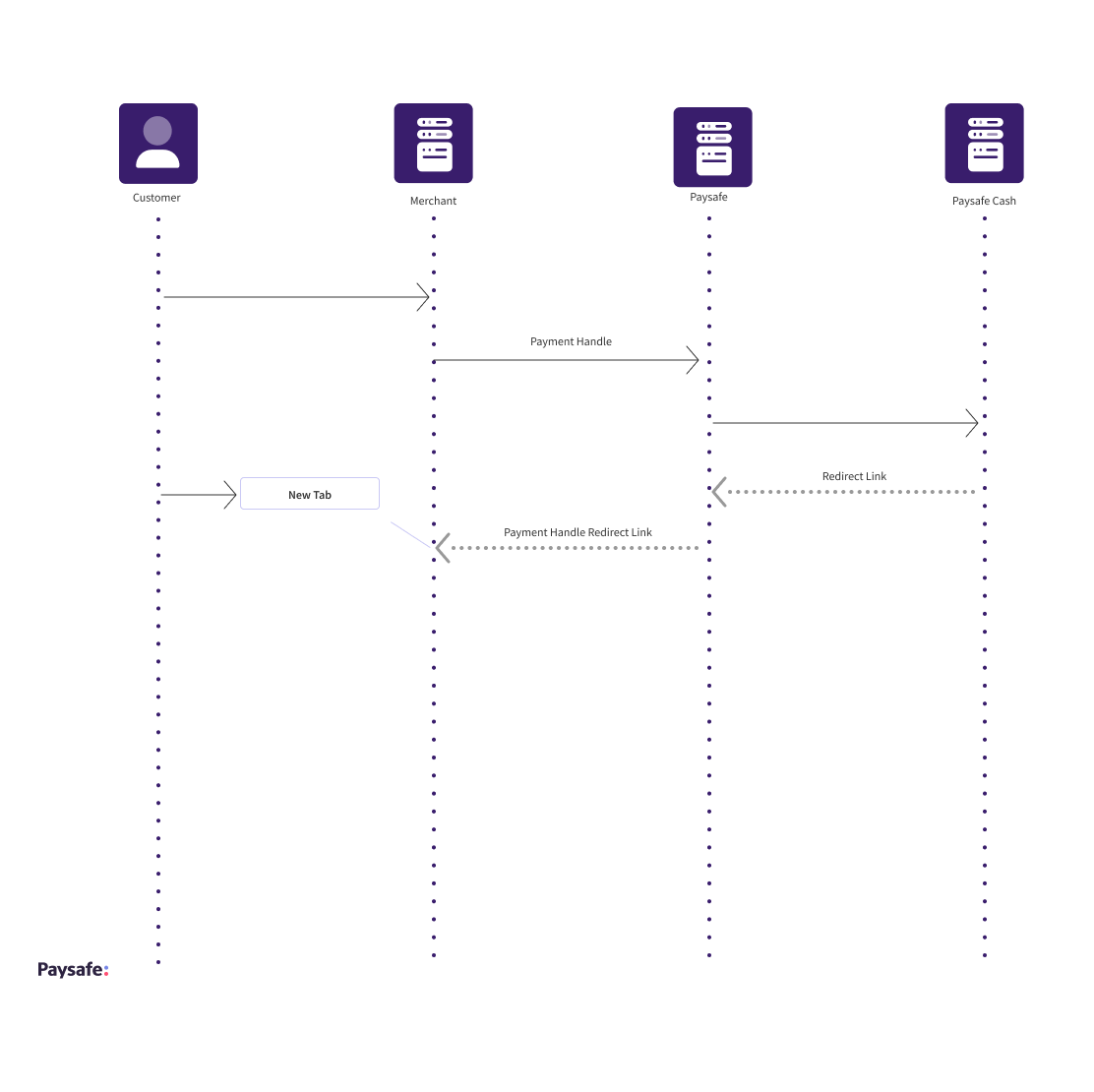

Paysafecash Payment - Redirection Flow

-

When processing a payment request with Paysafecash as the payment type, perform the following steps:

-

Create a Payment Handle with the transactionType parameter set to PAYMENT and the paymentType parameter set to PAYSAFECASH.

-

Paysafe provides the following response since the customer must complete payment authentication by entering Paysafecash details:

-

The action parameter is set to REDIRECT

-

A payment_redirect link points to the Paysafecash redirect URL

-

-

Redirect the customer to the Paysafecash redirect URL in order for them to generate a barcode.

-

The Payment Handle status changes to PAYABLE after successful barcode generation. This status update is communicated to the merchant using webhooks that have been configured.

-

To process the Payment request, use the paymentHandleToken supplied in the response. The Payment will have a status of PENDING until the customer has made the payment.

Once the Payment request is successfully completed, the merchant gets notified via webhooks and the funds are immediately transferred to the merchant's account.

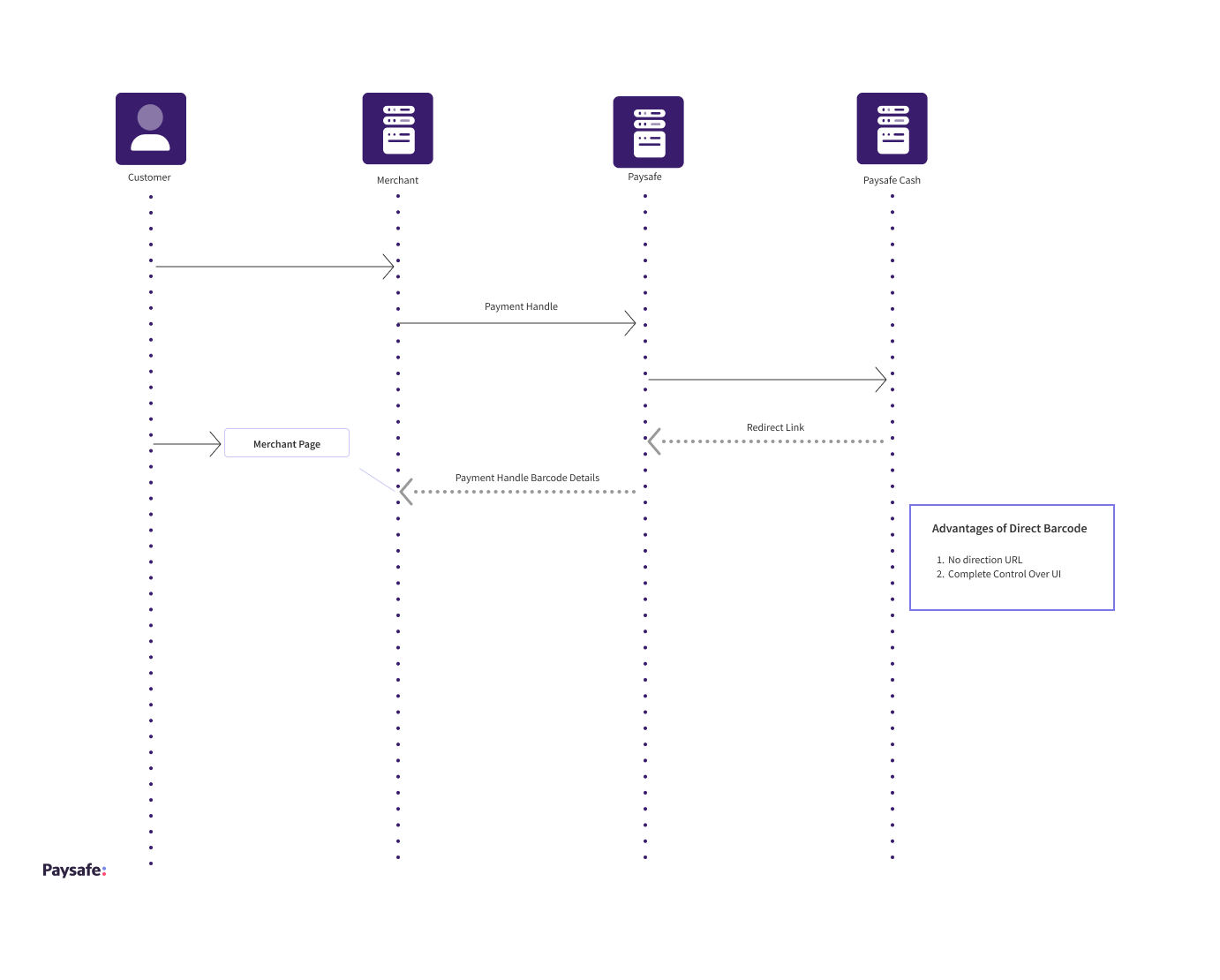

Paysafecash Payment - Direct Flow

When processing a payment request using Paysafecash as the payment type, perform the following steps:

-

Create a Payment Handle with the transactionType parameter set to PAYMENT and the paymentType parameter set to PAYSAFECASH.

-

Paysafe returns a response with the following barcodes array and Payment Handle status as PAYABLE.

"barcodes": [

{

"barcode": "799366433670000000000000160630",

"visualization": "CODE128",

"country": "US",

"expiresAt": "1663586164067"

}

]

| Parameter | Value |

|---|---|

| Barcode | Barcode value |

| Visualization | Barcode format |

| Country | Country sent in request |

| expiresAt | Barcode expiry time in Epoch format |

3. Display the Barcode to the user.

4. To complete the Payment request, use the paymentHandleToken returned in the response. The status of the payment will be PENDING until the customer makes the payment in-store.

APIs to use

Paysafecash Payment - Cancel Barcode

Available for both direct and redirect flow.

To cancel a barcode, perform the following steps:

-

Create a PUT HTTP call with Payment ID in the URL:

PUT/paymenthub/v1/payments/{paymentId} -

Pass below JSON in request body:

{

"status": "CANCELLED"

} -

You will receive response with status CANCELLED.

-

You can check Payment status using GET call:

GET/paymenthub/v1/payments/{paymentId}

Store Locator API

To fetch Paysafe Stores:

-

Create a GET call with the following parameters.

You will get a store list in the response.

Testing Instructions

Test Customer Id Values

Customer ID is also known as "Merchant Client ID", is an important parameter for the integration of paysafecard. The Customer ID identifies the Customer on our business partners side. The most optimal customer ID is a completely random value. A value that uniquely identifies the customer and is disconnected from any personal information. This customer ID value should be the same for all transactions of the customer. Here are Guidelines for possible Customer IDs:

Valid Values:

| Value | Type |

|---|---|

| 2c3be0b50c7a5f1964a63d78f38a6ffc41c027e9 | SHA1 - test@123.com |

| 742f2b1a55cd5d606ea44b4fcb54646a | MD5 - test@123.com |

| 3a5b0d0777dead9df93d502df85c8180e53804eb | SHA1 - UsernameValue1 |

| 3192481752123 | Random Customer Identifier |

| CustomerID1 | Customer Identifier free of personal information |

Invalid Values

| test@123.com |

| Username_1 |

| FirstName123 |

| LastName123 |

| Timestamp |

| IP Address |

Sending any form of the invalid values will not be accepted. If you intend to process paysafecard transactions on multiple brands, please inquire about the possibilities of separating multiple entities for your account.