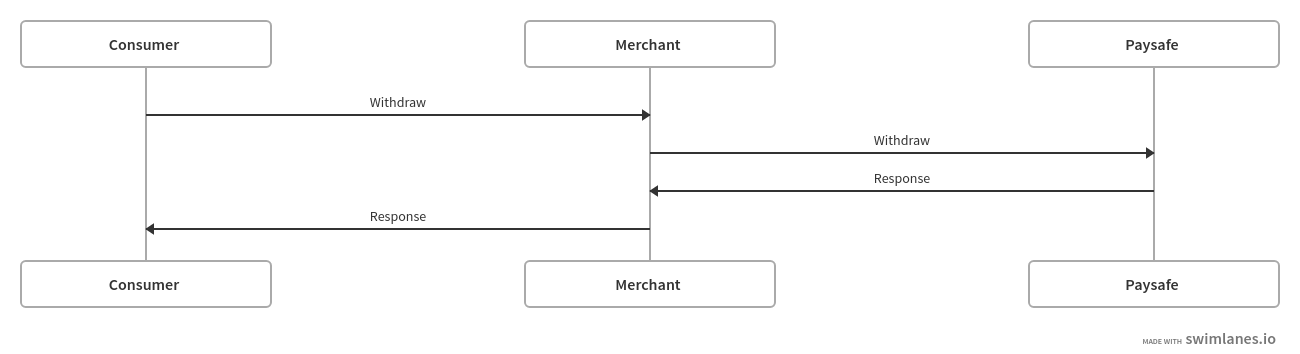

Use Case 2: Linked Withdrawals

This use case allows you to pay money to a consumer who has already made a payment on your webstore using Pay by Bank.

Implementation

Call the following endpoints in sequence:

- /paymenthub/v1/paymenthandles

(transactionType: VERIFICATION)

Initializes the verification process, which is a mandatory step in order to complete the subsequent steps.

-

/paymenthub/v1/verifications

Returns the list of bank accounts linked to the consumer.

- /paymenthub/v1/paymenthandles

(transactionType: STANDALONE_CREDIT)

Initializes the withdrawal by validating whether the request can be actioned (by checking if you have sufficient balance for example). It provides you with a payment handle token that you can then use to complete the payment.

-

/paymenthub/v1/standalonecredits

Moves money to the consumer and debits your balance.

NOTE: For code examples and detailed explanations of the parameters, refer to the Payments API Reference.

-

Call endpoint /paymenthub/v1/paymenthandles

- transactionType: VERIFICATION

- paymentType: PAY_BY_BANK

-

Pass the required parameters in the payByBank object.

-

If this is a new consumer, pass the required parameters in the billingDetails and profile objects.

NOTE: This step is identical to the paymenthandles for verifications call used when making a Pay by Bank payment. For more information about the payment handle status and potential call outcomes, see Pay by Bank Payments - STEP 1: Call paymenthandles for verifications.

-

Call endpoint /paymenthub/v1/verifications using the paymentHandleToken.

-

The payment handle status changes to COMPLETED.

-

-

Paysafe returns our verifications response, indicating that the request status is COMPLETED and providing a paymentHandleToken for each registered bank account.

NOTE: This step is identical to the verifications call used when making a Pay by Bank payment. For more information about the paymentHandleToken, see Pay by Bank Payments - STEP 2: Call verifications.

-

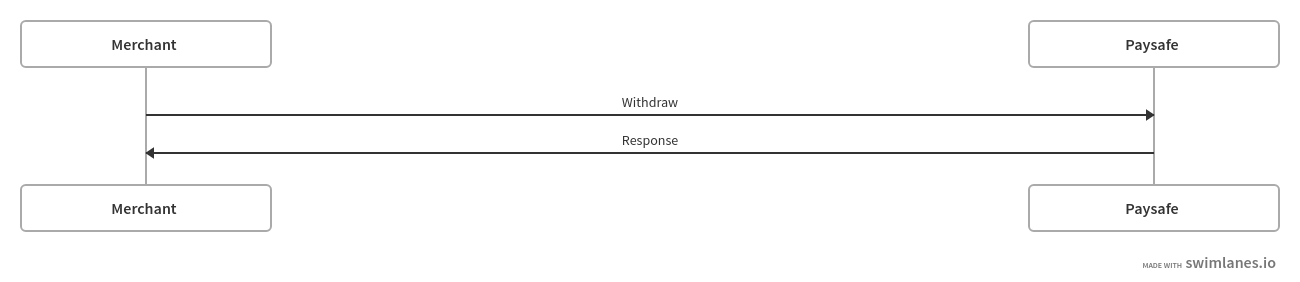

Call endpoint /paymenthub/v1/paymenthandles

- transactionType: STANDALONE_CREDIT

- paymentType: PAY_BY_BANK

-

Pass the required parameters in the payByBank object.

-

Paysafe creates a payment handle and returns our standard gateway response, indicating either a positive or negative outcome:

Positive outcome: Happy path

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)The request succeeds.

N/A

N/A

YES

(external)Negative outcomes: Unhappy path - the request fails

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)The Paysafe token is

not used within 15

minutes.PAYMENT_HANDLE_EXPIRED YES

(external)Auto triggered

after 15 mins. -

The payment handle status depends on the outcome of the request:

- For positive scenarios, the payment handle is created with status PAYABLE.

- For negative scenarios, the payment handle is created with status FAILED.

-

Call endpoint /paymenthub/v1/standalonecredits using the paymentHandleToken.

-

Paysafe returns our standard gateway response, indicating either a positive or negative outcome:

Positive outcome: Happy path

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)The request succeeds.

N/A

N/A

YES

(external)Negative outcomes: Unhappy path - the request fails

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)The Paysafe token is

not used within 15

minutes.PAYMENT_HANDLE_EXPIRED YES

(external)Auto triggered

after 15 mins. -

The payment handle status depends on the outcome of the request:

- For positive scenarios, the status first changes to PROCESSING and then to COMPLETED.

- For negative scenarios, the status changes to FAILED.

- For negative scenarios where the token expires after 15 minutes, the status changes to EXPIRED.

-

Following a successful withdrawal, the consumer receives email confirmation of the payout.