Pay by Bank (US)

Pay by Bank allows consumers to make instant, real-time payments and withdrawals on merchant webstores direct from their bank account via the US-based Automated Clearing House (ACH) network.

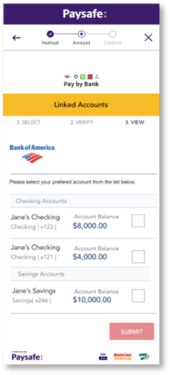

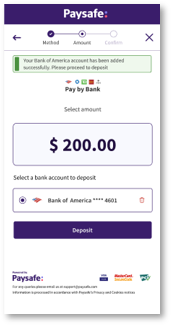

To use Pay by Bank, a consumer simply logs into their existing bank interface to connect their account, and from that point they can use their bank account to pay with a single click.

For more details, see About Pay by Bank (US) | Payments API.

Supported use cases

You can make the following types of transaction:

- Use case 1: Payments

- Use case 2: Linked withdrawals

Use case 1: Payments

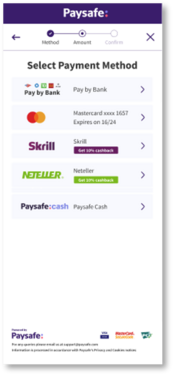

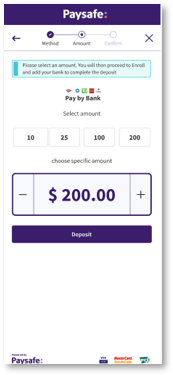

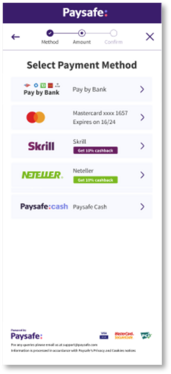

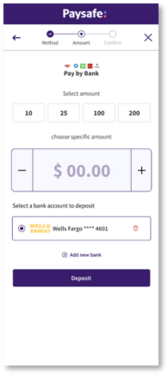

This use case enables your consumer to choose Pay by Bank as a payment option on Paysafe Checkout and to make a payment using their bank account.

Implementation - payments

When a consumer clicks Pay on your webstore:

-

Invoke Checkout to show payment methods to the consumer:

- Pass core checkout parameters and the following additional mandatory objects:

customer

billingAddress

payByBank (within the paymentMethodDetails object, passing only the consumerId)

- Pass core checkout parameters and the following additional mandatory objects:

-

Create a resultCallback function to capture the status of the payment handle and the details of the transaction e.g. amount and payment type.

-

You receive webhooks to notify you about the progress of the payment (if webhooks are enabled).

Positive outcome: Happy path

Outcome Paysafe

HTTP

Status CodeLPM Error

Code/ MessageCan be

simulated?How to

simulatePayment

handle

statusNext

actionConsumer chooses their

bank and selects Pay.N/A

N/A

CREATED

Payment is sent for authorization. N/A N/A PROCESSING Payment is authorized. N/A N/A PAYABLE Call the payments

endpoint to complete

the paymentNegative outcomes: Unhappy path - the request fails

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodePayment

handle

statusNext

actionPayment is not

authorized.400 9140 Payment handle failed with status:400 N/A FAILED -

Call payments

- Call endpoint /paymenthub/v1/payments

use the paymentHandleToken returned in the resultCallback

submit the amount and transactionType returned in the resultCallback - Paysafe returns our standard gateway response, indicating either a positive or negative outcome:

Positive outcome: Happy path

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)Paysafe settles the

payment.N/A

N/A

YES

(external)Negative outcomes: Unhappy path - the request fails

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)The payment handle

is not in PAYABLE

status.400 5283 Payment Handle

is invalidYES

(external)The Paysafe token is

not used within 15

minutes.PAYMENT_HANDLE_

EXPIREDYES

(external)Auto triggered

after 15 mins. - Call endpoint /paymenthub/v1/payments

Sample code - payments

<html>

<head>

<script src="https://api.test.paysafe.com/checkout/v2/paysafe.checkout.min.js"></script>

</head>

<body>

<button onclick="checkout()">Deposit</button>

</body>

<script>

function checkout() {

var API_key = "c3V0LTM0ODg2MDpCLXFhMi0wLTVkM2VjYjMwLTEtMzAyYzAyMTQyYTM3NjgxMmE2YzJhYzRlNmQxMjI4NTYwNGMwNDAwNGU2NWI1YzI4MDIxNDU1N2EyNGFiNTcxZTJhOWU2MDVlNWQzMjk3MjZjMmIzZWNjNjJkNWY=";

options = {

currency: "USD",

amount: 540,

merchantRefNum: "162938285366512",

customer: {

firstName: "John",

lastName: "Doe",

email: "DoeJohn.0309@gmail.com",

phone: "5464655142",

identityDocuments: [{

type: "SOCIAL_SECURITY",

documentNumber: "000000192",

}],

dateOfBirth: {

"year": 1980,

"month": 5,

"day": 3

}

},

billingAddress: {

"nickName": "Shalonda's Address",

"street": "9194 Peachtree Dunwoody Rd ",

"city": "Atlanta",

"zip": "30328",

"country": "US",

"state": "GA"

},

paymentMethodDetails: {

payByBank :{

consumerId:"112223333" //Mandatory Parameter, providing the ConsumerId will lock the consumer and load saved bank accounts.

}

}

};

paysafe.checkout.setup(

API_key,

options,

function resultCallback(instance, error, result) {

if (result && result.paymentHandleToken) {

instance.showSuccessScreen( "Your goods are now purchased. Expect them to be delivered in next 5 business days.");

if (instance.isOpen()) {

instance.close();

}

// make AJAX call to Payments API

} else {

console.error(error); // Handle the error

instance.showFailureScreen( "The payment was declined. Please, try again with the same or another payment method.");

}

},

function(stage, expired) {

if (stage) {

switch (stage) {

case "PAYMENT_HANDLE_NOT_CREATED" :

case "PAYMENT_HANDLE_CREATED" :

case "PAYMENT_HANDLE_REDIRECT" :

case "PAYMENT_HANDLE_PAYABLE" :

default:

}

}

else {

console.log(expired) //Add action in case Checkout is expired

}

}

);

}

</script>

</html>

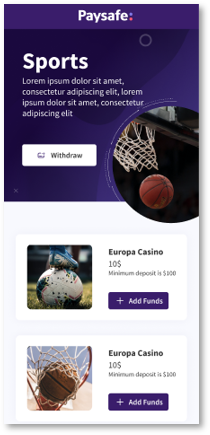

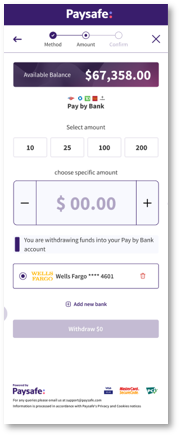

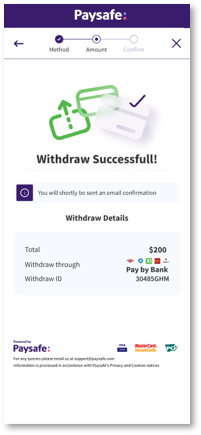

Use case 2: Withdrawals

This use case allows you to pay money to a consumer who has already made a payment on your webstore using Pay by Bank.

Implementation - withdrawals

When a consumer clicks Withdraw on your webstore:

-

Invoke Checkout to show payment methods to the consumer:

- Pass core checkout parameters and the following additional mandatory objects:

customer

billingAddress

payByBank (within the paymentMethodDetails object, passing only the consumerId)

- Pass core checkout parameters and the following additional mandatory objects:

-

Create a resultCallback function to capture the status of the payment handle and the details of the transaction e.g. amount, paymentHandleToken and transactionType.

-

You receive webhooks to notify you about the progress of the withdrawal (if webhooks are enabled).

-

Call standalonecredits:

- Call endpoint /paymenthub/v1/standalonecredits

use the paymentHandleToken returned in the resultCallback - Paysafe returns our standard gateway response, indicating either a positive or negative outcome:

Positive outcome: Happy path

You receive transaction and settlement details in the response that can be used for reconciliation. Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)The request succeeds. N/A

N/A

YES

(external)Negative outcomes: Unhappy path - the request fails

Outcome Paysafe

HTTP

Status CodePaysafe

Error

CodePaysafe

Error

MessageLPM

Error

CodeCan be

simulated?Magic

Value

(Amount)The Paysafe token is

not used within 15

minutes.PAYMENT_HANDLE_

EXPIREDYES

(external)Auto triggered

after 15 mins.The payment handle status depends on the outcome of the request:

- For positive scenarios, the status first changes to PROCESSING and then to COMPLETED.

- For negative scenarios, the status changes to FAILED.

- For negative scenarios where the token expires after 15 minutes, the status changes to EXPIRED.

- Call endpoint /paymenthub/v1/standalonecredits

Code sample - withdrawals

<html>

<head>

<script src="https://api.test.paysafe.com/checkout/v2/paysafe.checkout.min.js"></script>

</head>

<body>

<button onclick="checkout()"> Withdrawal </button>

</body>

<script>

function checkout() {

var API_key = "c3V0LTM0ODg2MDpCLXFhMi0wLTVkM2VjYjMwLTEtMzAyYzAyMTQyYTM3NjgxMmE2YzJhYzRlNmQxMjI4NTYwNGMwNDAwNGU2NWI1YzI4MDIxNDU1N2EyNGFiNTcxZTJhOWU2MDVlNWQzMjk3MjZjMmIzZWNjNjJkNWY=";

options = {

currency: "USD",

amount: 540,

merchantRefNum: "162938285366512",

payout:true,

customer: {

firstName: "John",

lastName: "Doe",

email: "DoeJohn.0309@gmail.com",

phone: "5464655142",

identityDocuments: [{

type: "SOCIAL_SECURITY",

documentNumber: "000000192",

}],

dateOfBirth: {

"year": 1980,

"month": 5,

"day": 3

}

},

billingAddress: {

"nickName": "Shalonda's Address",

"street": "9194 Peachtree Dunwoody Rd ",

"city": "Atlanta",

"zip": "30328",

"country": "US",

"state": "GA"

},

paymentMethodDetails: {

payByBank :{

consumerId:"112223333" //Mandatory Parameter, providing the ConsumerId will lock the consumer and load saved bank accounts.

}

}

};

paysafe.checkout.setup(

API_key,

options,

function resultCallback(instance, error, result) {

if (result && result.paymentHandleToken) {

instance.showSuccessScreen( "Your goods are now purchased. Expect them to be delivered in next 5 business days.");

if (instance.isOpen()) {

instance.close();

}

//Check paymentHandleToken Stage to initiate next step

} else {

console.error(error); // Handle the error

instance.showFailureScreen( "The payment was declined. Please, try again with the same or another payment method.");

}

},

function(stage, expired) {

if (stage) {

switch (stage) {

case "PAYMENT_HANDLE_NOT_CREATED" :

case "PAYMENT_HANDLE_CREATED" :

case "PAYMENT_HANDLE_REDIRECT" :

case "PAYMENT_HANDLE_PAYABLE" :

default:

}

}

else {

console.log(expired) //Add action in case Checkout is expired

}

}

);

}

</script>

</html>